JLL (NYSE: JLL) has been recognized by Ethisphere, a global leader in defining and advancing the standards of ethical business practices, as one of the 2025 World’s Most Ethical Companies. For the 18th consecutive year, JLL has been honored for demonstrating exceptional leadership and a commitment to business integrity through best-in-class ethics, compliance and governance practices.

In 2025, 136 honorees were recognized spanning 19 countries and 44 industries.

LaSalle is a wholly owned subsidiary of JLL and is proud to share in this achievement.

Company news

No results found

London (November 27, 2024) –Europe’s real estate cycle has reached a new dawn, following a deep capital market correction over recent years, according to the European chapter of the ISA Outlook 2025 report published by global real estate investment manager LaSalle Investment Management (“LaSalle”).

Last year’s ISA Outlook described the beginning of adjustment to the new reality of higher interest rates and challenging macroeconomic conditions. As we approach a new year, the latest ISA Outlook describes how market evidence is crossing thresholds that point to a new cycle. For example, data tracked by LaSalle’s asset managers show, from January 2024 to date, rents for new commercial leases across LaSalle’s European portfolio grew 2.7% relative to expiring passing rent, representing a return to an above-inflation pace.

LaSalle estimates that expected go-forward returns for the overall European property market are at their highest level in a decade. As capital slowly returns to the market and yield spreads exceed long-term averages, the real estate outlook has diverged from the region’s weak pace of economic growth due to a combination of supply barriers and asset quality polarisation.

This year’s report identifies strategic themes for investment in European real estate, which earn the region’s real estate assets an important place in investors’ property portfolios.

Beyond beds and sheds

A laser focus on “beds and sheds” has become a market consensus portfolio theme for many real estate investors, yet it is now becoming too simplistic to capture the more complex dynamics of the market.

Today’s ISA Outlook 2025 report uses fair value analysis to zero in on the best opportunities across a range of real estate capital and debt strategies and asset classes. These span all property types – not for the sake of diversification – but because we believe there are specific compelling opportunities that span across property types.

The European chapter of ISA Outlook 2025’s five strategic themes:

- Don’t forget a (real estate debt) umbrella: Real estate debt strategies can guard against inclement market conditions. New performance data for European debt funds shows the benefits of preparedness. Debt investors are also taking advantage of the choice between fixed-rate and floating-rate lending positions, and the diversification benefits of investing in both.

- Follow the hexagons for logistics: In our Paths of Distribution Score, we have mapped Europe into 158,455 hexagons – scoring each on their centrality, from an occupier perspective, for distributing goods to the most consumers at the lowest cost – and we favour logistics strategies that focus on the top-scoring hexagons within the highest ranked markets in our fair value analysis (in France, the Netherland and Germany).

- Retail back on the menu: European retail has been through a deep reset, and select retail formats now look too attractive to ignore. Outlet centres in the UK and Northern Europe offer strong alignment between tenants and operators, while Spanish and French retail parks and convenience shopping centres in the Netherlands can also deliver high income returns.

- Master adapters – how Europe’s office markets are different: Europe is leading the office market’s adaptation to hybrid work, as their largely mixed-use, mid-rise character, creates distinctive opportunities. A rebalanced office sector is not a distant next buyer prospect for many of Europe’s markets – it’s happening now. This is evident in return-to-office figures as well as property fundamentals. London City office market vacancy has now declined for five consecutive quarters, driving prime rent growth.

- A residential and living smörgåsbord: European residential (or living) is not really a single property type, it is a large collection of sub-sectors with widely varying cash flow profiles, pricing, regulation and target occupiers. There continue to be opportunities, but sector selection is paramount, with PBSA standing out in Spain and Germany.

Global uncertainty but clear opportunities

The European ISA Outlook forms part of LaSalle’s Global ISA Outlook, which finds that the new dawn extends across real estate around the world.

Greater clarity on the direction of interest rates around the world should help drive healing of the capital markets in 2025, with hesitant sellers gaining confidence as pricing starts to come in closer to their expectations.

There have, of course, been significant political developments in the US in recent weeks. The Global ISA Outlook reflects on how the “Red Sweep” may affect the real estate investment outlook and the shape of the dawning cycle, with signals pointing towards marginally higher growth, inflation and rates, but no great change in the overall outlook. LaSalle expects that the US economy remains on track for a soft landing. Equally, the European ISA Outlook considers the potential impact of the US Election in Europe, recognising that a stronger dollar could result in a possible boost in student demand for housing and tourist demand for hotel rooms.

The Global ISA Outlook also identifies areas of concern, with China a significant ‘soft spot’ due to a combination of generationally low growth and liquidity alongside weak property fundamentals. The Chinese government has made significant interventions to shore up the economy, and in recent weeks further stimulus has been implemented to guard against the potential onset of US tariffs on Chinese goods. These factors mean that China is something of a unique case in the ISA Outlook, with less applicability of global trends. Similarly, the Japanese market is experiencing a different cycle to the rest of the world. Japan is in the process of exiting a long period of deflationary risk and rock-bottom rates, so unlike other countries, monetary policy in Japan has a modest tightening bias.

Dan Mahoney, Head of European Research and Strategy at LaSalle, said: “We are seeing a new cycle dawning for Europe’s real estate markets. Today’s Europe ISA Outlook delves into why we believe we are entering a new cycle, evidence of data thresholds crossed, and our strategy for the years ahead. These go beyond simple ‘beds and sheds’ – which is too simplistic to capture the complexity of European real estate today.”

Brian Klinksiek, Global Head of Research and Strategy at LaSalle, added: “Global real estate sentiment is gradually improving following a long period of negativity and signs are pointing to the beginning of a new real estate cycle. History has shown that investing early in a cycle tends to lead to relatively strong performance. There are, however, still risks on the horizon, and investors are advised to focus on diversified strategies that are flexible and broad enough to adapt to a complex and evolving relative value landscape. A comprehensive look at value across a wide range of sectors and markets will be required to build a well-positioned real estate portfolio.”

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$88.2 billion of assets in private and public real estate equity and debt investments as of Q3 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

Paris / Île-de-France is home to Europe’s top micro-locations for efficient logistics distribution, according to the inaugural release of the Paths of Distribution score, published today by LaSalle Investment Management (“LaSalle”). The innovative, granular new research gives the ability to compare logistics locations at a micro, market, country and pan-European level, with extensive flexibility for understanding, benchmarking and ranking locations at both micro and macro scale.

The Netherlands, thanks to its immediate access to Europe’s major consumption centres and having one of the crossroads of trade within and into Europe, was identified as the strongest-performing country. The port city of Rotterdam, the key gateway of global trade, ranked second and is joined in the top 20 regional markets by local rivals Amsterdam and the North Brabant region of Breda and Tilburg. Germany, the second-best performing country, provided another five of Europe’s top 20 markets, all in the west of the country, establishing this corner of north-western Europe as a hotspot for manufacturing and transportation. The UK, although separated from continental European logistics markets, placed third in the country standings, with Greater London its highest-ranked logistics market, although the West and East Midlands, the North-West of England (surrounding Manchester) and Kent all placed in the top 20 thanks to their strong infrastructure.

Belgium was fourth best performing, with the Antwerp and Brussels markets ranking seventh and seventeenth respectively. The wider Milan region also scored highly in the rankings, despite comparatively low investment volumes historically, while the Veneto-Verona corridor was another Italian market which scored well, with domestic consumption being the primary driver. Likewise, in Poland, the biggest winners were the Katowice-Krakow corridor and Lodz – ranking above the capital Warsaw – both growing notably in recent years and benefitting from investment in infrastructure and labour availability. LaSalle’s analysis shows there is a positive correlation between Paths of Distribution and logistics take-up, making a connection between current demand and these locations’ potential.

Micro-location and methodology

The research is the first of its kind, and takes an innovative, granular approach to its methodology, breaking the continent down into 158,445 10-kilometre hexagons. Each micro-location is scored across four key pillars of manufacturing output, consumer spend, infrastructure quality and the proximity to skilled labour. The model not only factors in demand, but also considers the cost from an operator’s perspective of meeting that demand, using an extensive set of region-to-region road freight transport cost metrics, along with a random forest machine learning model evaluating how extensive and accessible the road network is at the most granular level.

The top scoring micro-location hexagons are in the Eastern Crescent that semi-circles Paris, stretching from the area surrounding the Charles de Gaulle airport in the north, moving south-east through Noisy-le-Grand, then continuing south covering Créteil. This sub-market of Paris benefits from excellent connectivity into Paris, as well as to the wider French market, and further north and east.

Logistics distribution scoring is unlike other city rankings because it is about far more than central cities – entire regions and all the micro-locations within them are potentially efficient places for distribution. So the LaSalle team took a new approach filling in all the gaps in the regions of Europe between cities. The vibrant maps showing location scores across all of Europe highlight the corridors, conurbations, clusters, and crescents which define the optimal locations for modern logistics.

Petra Blazkova, Head of Research & Strategy, Core & Core-Plus Capital, Europe at LaSalle, said: “With continued uncertainty around energy prices and supply chains being disrupted, cost uncertainty is high across the continent for logistics providers. Location is a key variable which distributors can still control, and so it is more important than ever: optimising your choice of location can help minimise exposure to these other risks and protect your supply chain. Today’s rankings demonstrate which areas are best for distributors to try to insulate themselves from those pressures. As investors in the sector, this new insight into the most resilient logistics markets in Europe informs our portfolio composition and asset management.”

The full top 20 logistics markets were as follows:

1 Paris / Île-de-France, France

2 Rotterdam, The Netherlands

3 Frankfurt-Mainz, Germany

4 Milan, Italy

5 Greater London, United Kingdom

6 Rhine-Ruhr, Germany

7 Antwerp, Belgium

8 West Midlands, United Kingdom

9 Madrid, Spain

10 Dortmund, Germany

11 Amsterdam, The Netherlands

12 East Midlands, United Kingdom

13 Stuttgart, Germany

14 North West England (Manchester), United Kingdom

15 North Brabant (Breda-Tilburg), The Netherlands

16 Karlsruhe-Mannheim corridor, Germany

17 Brussels, Belgium

18 Veneto-Verona corridor, Italy

19 Kent, United Kingdom

20 Barcelona, Spain

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

Company news

No results found

London (June 4, 2024) – LaSalle Investment Management, the global real estate investment manager, has provided a loan facility of €150 million through its flagship real estate debt fund, LREDS IV, to refinance a portfolio of 17 big-box logistics assets across Europe owned by Brookfield through its private real estate funds.

Brookfield has partnered with leading development managers Panattoni and Logistik Service to source opportunities, develop and lease the projects. The portfolio includes 17 projects across Sweden, Spain, Germany and Poland, split between six completed projects (five of which are fully let), four in development and seven consented plots. It focuses on grade-A high-specification logistics assets with a typical BREEAM rating of Very Good or Excellent.

David White, Head of LaSalle Real Estate Debt Strategies, said: “Working with a best-in-class sponsor in Brookfield and two top-tier development managers in Panattoni and Logistik Service means our facility is secured against some of the highest-quality assets and projects available in the European logistics market. Our team works to provide bespoke solutions to our borrower’s needs, and we are pleased to support such a high-quality logistics portfolio.”

Rohit Srivastava, Managing Director in Brookfield’s Real Estate Group, added: “We are pleased to work with LaSalle to complete this refinancing, which will support the continued growth of our portfolio of big-box logistics assets. The team were able to provide a bespoke financing package that addressed our requirements.”

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages almost US $87 billion of assets in private and public real estate equity and debt investments as of Q1 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information, please visit www.lasalle.com, and LinkedIn.

About LaSalle Debt Investments

LaSalle Debt Investments is part of LaSalle’s growing $US 10 billion Debt and Value-Add Strategies platform in Europe and invests in a diverse range of real estate credit solutions – spanning senior loans, whole loans, mezzanine, development finance, corporate finance, NAV facilities and preferred equity – with significant experience across various sectors, geographies, deal sizes and capital structures. Since launching the business line in 2010, LaSalle has been one of Europe’s most active alternative real estate debt providers with a long track record of lending to best-in-class sponsors.

Marketing Disclaimer: This information is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for information purposes only and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results. Please refer to the offering documents Encore+ for detailed information on the risks, reward and performance information of the Fund.

Company news

No results found

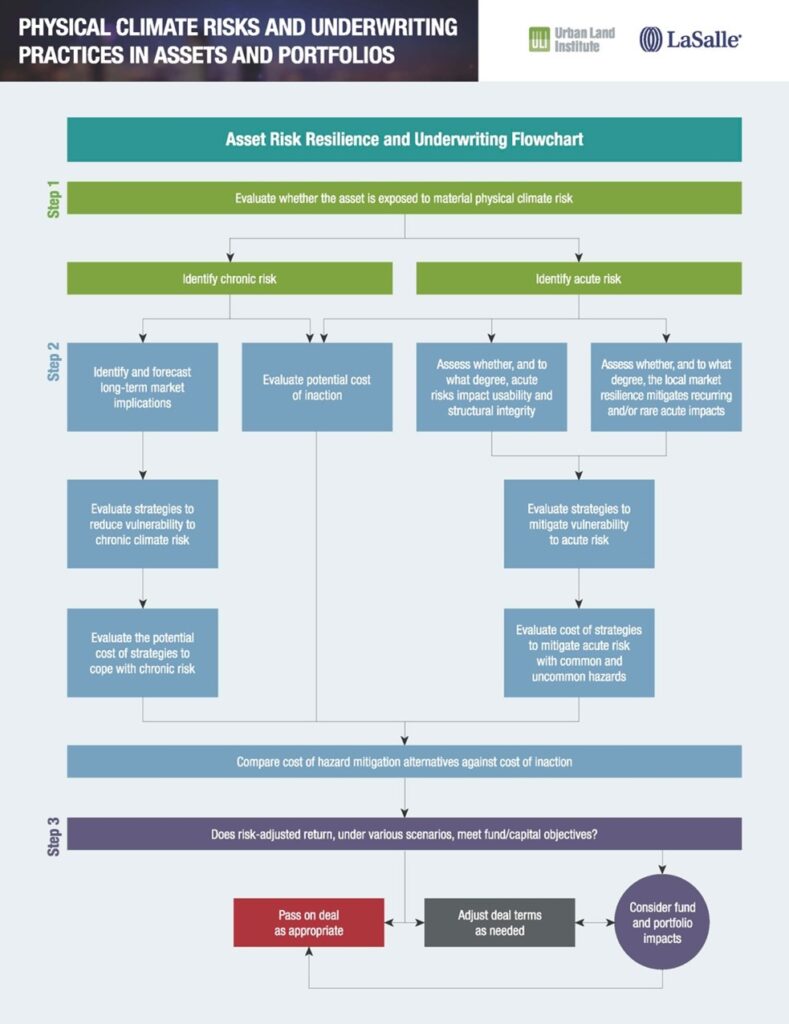

- Step-by-step framework to evaluate physical and financial risk and compare cost and benefits of resilience

- As of Q4 2023, of the US $850 billion of commercial real estate tracked by NPI, $285 billion, or 34% is situated in high and medium-high climate risk zones in the US, according to LaSalle’s Research and Strategy team analysis

Washington / New York (April 11, 2024) – A new global report from the Urban Land Institute (ULI) and LaSalle Investment Management (LaSalle), a leading real estate investment management firm, offers a new framework to help the real estate industry act on climate risk disclosure data. Across the real estate industry, practitioners understand physical climate risk to assets and portfolios poses a financial risk, but there are still many challenges to enacting on the data being collected and disclosed.

This new framework is the latest tool for real estate investors and other practitioners to evaluate the costs of action and inaction when it comes to investing in resilience. The report, Physical Climate Risks and Underwriting Practices in Assets and Portfolios, is the second in a series by ULI and LaSalle. Building on the first report that outlined how to source and interpret reliable climate risk data, the second provides a market overview, adaptable framework, and recommendations based on emerging best practices for incorporating physical climate risk in the underwriting process.

“Physical climate risk data collection and disclosure is the first step the real estate industry can take to further invest in and build resilient infrastructure,” said Lindsay Brugger, head of Urban Resilience at ULI. “Data drives action and doing nothing incurs deeper costs — from higher insurance premiums to asset repair or replacement. Focusing on the underwriting process, the framework offers investment managers a methodology for developing risk-adjusted returns so deals can be adapted in alignment with a firm’s fund or portfolio objectives.”

“Of the $850 billion of commercial real estate tracked by NPI, LaSalle estimates $285 billion, or 34% is situated in high and medium-high climate risk zones in the US,” said Julie Manning, Global Head of Climate and Carbon at LaSalle Investment Management. “This report helps provide guidance that investment managers can follow to factor the climate risk data they have available to them and improve outcomes at the asset and portfolio level. We want to lead the conversation across the industry and collaborating with ULI is a great conduit to amplify the discussion that will ultimately benefit investors of all kinds with more resilient real estate portfolios.”

The framework is broken down into three steps for decision making based on individual asset risks, local market risks, and ongoing risk mitigation efforts:

1. Evaluate the level of exposure to physical climate risk and financial implications;

2. Identify hazard mitigation strategies and estimate associated costs; and

3. Determine risk-adjusted return and whether or not that return meets firm objectives

The redevelopment will also look to meet future tenant requirements and evolving work trends with high-quality amenities to promote in-person interaction and facilitate a hybrid working, including an auditorium, business centre, bars and restaurants, event spaces and a media broadcast studio.

As climate impacts continue to influence real estate markets around the world, improving understanding of physical climate risk and adjusting pricing to reflect risk are growing imperatives. Firms can better navigate the complexities of physical climate risk and capitalize on emerging opportunities by leveraging this new report’s insights and guidance. Prioritizing knowledge diffusion and empowering informed decision-making processes is key to effectively managing and mitigating incoming climate risks in the evolving real estate industry, whether at a community or individual building scale.

The full report and downloadable framework can be found on ULI’s Knowledge Finder.

REPORTERS AND EDITORS: For more information, please contact:

ULI

LaSalle

Drew McNeill

About the Urban Land Institute

The Urban Land Institute is a non-profit education and research institute supported by its members. Its mission is to shape the future of the built environment for transformative impact in communities worldwide. Established in 1936, the institute has more than 48,000 members worldwide representing all aspects of land use and development disciplines. For more information on ULI, please visit uli.org, or follow us on Twitter, Facebook, LinkedIn, and Instagram.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages over US $89 billion of assets in private and public real estate equity and debt investments as of Q4 2023. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information please visit www.lasalle.com, and LinkedIn.

Company news

No results found

London (February 26, 2024) – LaSalle has been recognised as Real Estate Firm of the Year (ESG) at the New Private Markets Awards 2023 in recognition of the steps taken last year to embed sustainability across its operations in Europe.

LaSalle completed net zero carbon audits for 177 properties in the UK and continental Europe, created a dedicated NZC implementation team, and introduced sustainability-related performance targets for all investment-related employees, with 119 having already undertaken bespoke training.

Alex Edds, Head of Sustainability, Europe at LaSalle commented:

“This award recognises the significant progress we’ve made in delivering on our sustainability strategy in Europe, and in particular our net zero carbon programme. We remain committed to improving and delivering upon ours and our clients’ sustainability goals in ways that also drive investment performance.”

Read more about this year’s New Private Market Awards on the NPM website (subscription required): New Private Markets Awards 2023: ESG in fund management winners.

ENDS

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages approximately US $89 billion of assets in private and public real estate equity and debt investments as of Q3 2023. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

Company news

No results found

London and Zurich (February 5, 2024) – LaSalle Investment Management and Swiss Life Asset Managers complete a joint venture focusing on the German logistics market. The venture will recapitalise a €320 million seed portfolio of five grade-A fully let logistics assets contributed by Swiss Life Asset Managers and seek to acquire and develop additional logistics assets. Swiss Life Asset Managers will act as the asset and investor-developer manager and the insurance arm of Swiss Life will retain a minority equity stake in the aggregate portfolio.

The five seed assets, across the Rhein-Ruhr, Koblenz and Zwickau regions, have a total lettable area of 236,000m² with 100% CPI-indexed rents.

This investment presents LaSalle with an opportunity to partner with a best-in-class manager in a preferred sector, overseeing a portfolio of exceptional award-winning, state-of-the-art logistics assets in the robust German logistics market. The partnership is set to leverage Swiss Life Asset Managers’ fully integrated logistics platform and benefit from the sustained high demand for logistics assets in key trading and transport hubs across continental Europe.

Mathias Malzbender, Managing Director, LaSalle Global Solutions, commented: “This investment and partnership with Swiss Life Asset Managers, a leading institutional real estate developer and manager, provides us with an exceptional opportunity to expand in one of the most sought-after sectors in Europe. Swiss Life Asset Managers is a sophisticated and valued partner, and we look forward to building a successful relationship and continuing the success of this portfolio. Given that the German logistics market is among the top-performing in Europe, focusing and expanding in this region has long been a priority for us at LaSalle.”

Per Erikson, Head Real Estate at Swiss Life Asset Managers, added: “We are pleased to partner with LaSalle and create long-term value for our stakeholders. Our unique insights and access to the investment market as well as our development expertise have become a differentiating feature and a competitive advantage. I am particularly pleased that our European Logistics platform, headed by Ingo Steves, developed the exclusive seed portfolio for this venture. In LaSalle we have a like-minded and solid partner investing with us in the dynamic and promising European logistics market.”

ENDS

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages approximately US $89 billion of assets in private and public real estate equity and debt investments as of Q3 2023. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

About Swiss Life Asset Managers

Swiss Life Asset Managers has more than 165 years of experience in managing the assets of the Swiss Life Group. This insurance background has exerted a key influence on the investment philosophy of Swiss Life Asset Managers, which is governed by such principles as value preservation, the generation of consistent and sustainable performance and a responsible approach to risks. Swiss Life Asset Managers offers this proven approach to third-party clients in Switzerland, France, Germany, Luxembourg, the UK, Italy and the Nordic countries. As at June 30, 2023 assets under management for third-party clients amount to €114.8 billion. Together with insurance assets for the Swiss Life Group, total assets under management at Swiss Life Asset Managers stood at €265.8 billion. Swiss Life Asset Managers is a leading real estate manager in Europe.1 Of the assets totalling €265.8 billion, €91.7 billion is invested in real estate. In addition, Swiss Life Asset Managers, in cooperation with Livit, manages real estate totalling €21.6 billion in value. Total real estate assets under management and administration at the end of June 2023 thus came to €113.3 billion.

1 INREV Fund Manager Survey 2023 (AuM as of December 31, 2022)

Company news

No results found

London (January 29, 2024) LaSalle Investment Management (“LaSalle”), the global real estate investment manager, today announces that Alexandre Arhuis-Grumbach has been appointed to the newly created role of Head of Transactions Europe, Core and Core+ Strategies.

Previously Head of Encore+ Transactions, Alexandre will now oversee all transactions, across LaSalle’s core and core+ commingled funds (including the firm’s flagship Encore+ fund) and custom accounts in Europe.

In his new role, the core and core-plus transactions teams across the UK and continental Europe will report into Alexandre, who will in turn report into LaSalle’s Head of Europe, Philip La Pierre.

Alexandre has worked at LaSalle for more than 13 years, having joined in 2010 as a financial analyst on a pan-European Value-Add fund before becoming an acquisitions manager in France. He earned an MSc in Civil Engineering from the French school ESTP and an MSc in Real Estate Management from Glasgow Caledonian University. He is also a Member of the Royal Institution of Chartered Surveyors (MRICS).

Philip La Pierre, Head of Europe at LaSalle, said: “Alexandre’s newly created role will help drive core and core-plus transactions as the market continues its recovery from the macroeconomic headwinds it has faced. Having worked with LaSalle for well over a decade, Alexandre has been instrumental in the success of our flagship Encore+ fund and we are delighted that a wider range of our clients will now benefit from his transaction expertise.”

Alexandre Arhuis-Grumbach, Head of Transactions Europe, Core and Core+ Strategies at LaSalle, commented: “This is an exciting opportunity to lead LaSalle’s core and core-plus transactions at a critical time, working with a best-in-class team to source and execute transactions in line with our clients’ investment objectives. I am delighted to take on this new role and help ensure that LaSalle continues to expand across the UK and continental Europe, while maintaining its position as one of the world’s leading real estate investment managers.”

ENDS

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages approximately US $89 billion of assets in private and public real estate equity and debt investments as of Q3 2023. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

Company news

No results found

LONDON (29 November 2023) – Despite a challenging macroeconomic picture, European real estate has begun to acclimatise to higher interest rates and will offer some of the world’s most attractive supply-demand dynamics next year, according to the Insights, Strategy and Analysis (ISA) Outlook 2024 report published by global real estate investment manager LaSalle Investment Management (“LaSalle”).

Last year’s report predicted European macro headwinds and a stall in capital markets activity, but also strong real estate market fundamentals. Looking ahead, the 2024 ISA Outlook for Europe describes how investors that are ready to move out of waiting mode, with realistic expectations for operating income growth, can find compelling new investment opportunities.

This year’s report identifies five trends that differentiate Europe and earn the region’s real estate assets an important place in investors’ property portfolios:

- Europe’s city centre vibrancy and occupier demand have strongly rebounded

- The region’s firms and individuals are taking the lead in decarbonization

- Skilled migration is supporting growth

- Expansion of the EU’s single market is regaining traction

- The high prevalence of inflation-index commercial leases in the EU has helped the region’s property cash flows to better keep pace with inflation

These trends are driving demand in particular for logistics and rental housing, as well as superior performance by offices in the ‘super-prime’ segment.

Macro challenges but appealing supply-demand dynamics

Having defied expectations of a recession in 2023, Europe still faces elevated recession risk. Inflation has begun to abate but proven comparatively stubborn, particularly in the UK, inducing higher policy rates from the ECB and Bank of England. As the delayed impact of rising rates begins to bite, European property markets enter 2024 searching for a clear peak in interest rates – as well as an end to the war in Ukraine.

Europe’s occupational fundamentals are coming off the boil of recent years, with rental growth set to cool to its lowest level since 2020 next year. However, we expect that average rent growth should remain positive, especially for logistics and rental housing – even in an economic downturn – helped by low vacancy rates relative to history.

In logistics, while demand has cooled across Europe and vacancy is ticking up from extremely low levels, a shrinking construction pipeline means that the long-term revenue growth outlook remains very bright. The scope for further e-commerce market penetration is, conversely, a headwind for European retail. However, assets such as outlet centers with turnover-linked leases have lifted revenues in line with nominal sales growth.

Investors in Europe can access strategies rooted in barriers to supply, arising from Europe’s high (and rising) constraints on development. Nowhere does this apply more than in the residential sector, where the undersupply is chronic, while migration powers long-term demand growth. Surging student demand and rising mortgage rates are causing people to rent for longer and until later in life, boosting demand further in Purpose-Built Student Accommodation and rental housing specifically.

Opportunities on the leading edge of offices

European city centers are returning to their pre-Covid levels of vibrancy, attracting office occupiers and capital to more central locations. To better understand how this spectrum of office quality is evolving, we recommend going beyond ‘bifurcation’ alone in segmenting the market. The widening gaps between leading and lagging offices are determined by a range of many factors like location, design, amenities and sustainability.

In London, “super-prime” office buildings command significant rent premiums to “prime” averages. Since 2019, the UK capital’s median office relocation was from a non-BREEAM-rated EPC-D building to BREEAM Excellent / EPC-B or better. Across Paris and London, new offices’ vacancy rate is c.2%, three times less than for second-hand offices. Notably, centrally located, modern offices in Paris and Munich have defied subdued transaction levels and remain liquid, with sales attracting respectable bidder pools.

Alternative lenders gain momentum

Outside of these pockets of investment activity, alternative lenders are well positioned to solve capital stack equations in 2024, filling gaps created by banks’ reduction in LTVs to provide debt financing that generates attractive risk-adjusted returns.

Dan Mahoney, Head of European Research and Strategy at LaSalle, said: “What we are seeing in Europe is real estate markets beginning to acclimatise to the higher-rate environment and gradually shift out of the waiting mode that has chilled transaction volumes in 2023. The continent’s distinct combination of rebounding city vibrancy, high supply barriers and compelling conditions for debt make it an important allocation in global real estate portfolios.”

Brian Klinksiek, Global Head of Research and Strategy at LaSalle, added: “Significant unknowns remain in the global real estate market as we head into 2024, including interest rates, geopolitical tensions, and whether major economies may tip into recession. While it’s very difficult to time markets, data on previous down cycles suggest that it’s often during unsettled periods that savvy investors can find strong value in real estate, making this a potentially strong vintage for investment.”

Ends

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages approximately $78 billion of assets in private and public real estate property and debt investments as of Q1 2023. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information, please visit www.lasalle.com, and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LONDON (11 April 2023) – LaSalle Investment Management (“LaSalle”), the global real estate investment manager, today announces that LaSalle Debt Investments, one of Europe’s largest alternative real estate lending platforms, has expanded its senior-secured debt strategies to include a dedicated sustainable lending focus. In the last year, the platform has provided over €350 million of green loans across Europe.

LaSalle Debt Investments has grown its capacity to support borrowers in retrofitting existing assets to improve their energy performance and fund the construction of the next generation of energy-efficient buildings across the UK and continental Europe.

Recent green loan activity includes a £148m senior facility to support the construction of a PBSA scheme in central London, a £115m development facility to support a multi-asset regional UK PBSA portfolio, and a €40m mezzanine facility to support the retrofit of a Berlin office asset.

LaSalle was recently recognised as ‘ESG Firm of the Year’ in the 2022 PERE Awards, acknowledging the combination of strategic hires, initiatives and deals that embed sustainability as a critical pillar of the firm’s long-term corporate strategy and overall investment philosophy.

Richard Craddock, Managing Director, leading LaSalle’s senior-secured debt strategies, said: “As the drive towards Net Zero Carbon accelerates, we continue to support our European borrowers to deliver high-quality, sustainable accommodation across sectors. Demand for loans to finance green refurbishments and the construction of energy-efficient developments will likely increase as the need to decarbonise gathers further momentum. By adding a dedicated green loan focus to our existing senior-secured strategies, LaSalle is able to provide a crucial source of capital to help reduce European real estate’s carbon footprint.”

LaSalle’s green loan structures are compliant with the Loan Market Association’s green loan framework.

LaSalle Debt Investments has over €1.5bn lending capacity in Europe across its credit strategies, which include senior loans, whole loans, mezzanine, and development finance. It forms part of LaSalle’s pan-European Debt & Value-Add Strategies division, which provides debt and equity capital solutions across European markets and sectors.

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages approximately $79 billion of assets in private and public real estate property and debt investments as of Q3 2022. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information, please visit www.lasalle.com, and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

About LaSalle Debt Investments

LaSalle Debt Investments is part of LaSalle’s growing $10bn Debt & Value-Add Strategies platform in Europe and invests in a diverse range of real estate credit products – spanning senior loans, whole loans, mezzanine, development finance, corporate finance, NAV facilities and preferred equity – with significant experience across various sectors, geographies, deal sizes and capital structures. Since launching the business line in 2010, LaSalle has been one of Europe’s most active alternative real estate debt providers with a long track record of lending to best-in-class sponsors.

Company news

No results found

LONDON (9 January 2023) – LaSalle Investment Management (“LaSalle”) today announces that Beverley Kilbride has been appointed to the role of Chief Operating Officer (COO), Europe.

Following this appointment, Beverley will lead operations across LaSalle’s unified European team, with her remit comprising sustainability, asset management, operations, digital projects and capital markets. She will focus on integrating and implementing strategic operational efficiencies across all European investments, assets and funds, reflecting LaSalle’s integrated approach globally.

Beverley will also become the Chair of LaSalle’s European Diversity, Equity & Inclusion (‘DE&I’) Operating Committee, succeeding Brian Klinksiek, LaSalle’s Global Head of Research & Strategy.

Having joined LaSalle in 2006 from JLL, Beverley has worked across asset management, acquisitions and fund management. Based in the firm’s Paris office, Beverley successfully spearheaded LaSalle’s return to the Dutch market in 2013 and gained hands-on asset management and investment experience overseeing a selection of strategic value-add assets across Europe.

After assuming the role of Head of Transactions & Asset Management for Europe in July 2021, Beverley oversaw and managed the acquisitions and asset management teams. In this time, Beverley established LaSalle’s European Asset Management Board and specialist European Development & Repurposing team, with the in-house capability of delivering larger, more complex and higher-return developments.

In her new role, Beverly remains head of LaSalle’s French regulated business.

Philip La Pierre, Head of Europe for LaSalle, said: “Beverley’s new appointment reflects LaSalle’s continued focus on ensuring the alignment and efficiency of the firm’s operations across Europe and globally. Her newly created role will help further drive LaSalle’s investment performance as we continue to embed sustainability considerations across our portfolio. Having been with LaSalle for over 15 years, Beverley has built a highly successful track record and is instrumental to delivering on our ambitions in Europe on behalf of our clients.”

Beverley Kilbride, Chief Operating Officer, Europe, for LaSalle, commented: “This role offers an exciting opportunity to work closely with our operational, sustainability and investment teams to help drive further transformation across LaSalle’s integrated European and global business. I am delighted to take on this new role at a pivotal time and help ensure that LaSalle maintains its position as one of the world’s leading real estate investment managers.”

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages approximately $79 billion of assets in private and public real estate property and debt investments as of Q4 2022. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

Investing today. For tomorrow.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

LaSalle Investment Management (“LaSalle”) has announced a series of additions and enhancements to its European Research & Strategy leadership team, reflecting a deepened focus on its key investor products and an emphasis on driving competitive investment performance.

Dan Mahoney succeeds LaSalle’s newly appointed Global Head of Research & Strategy, Brian Klinksiek, as Head of European Research & Strategy, effective 1 January 2023. He brings over 14 years’ experience as a strategist in the firm’s North America Research & Strategy team, where he helped drive investment performance through a range of successful initiatives, including a focus on LaSalle’s US residential strategies. During that time, he acted as the Research & Strategy team’s chief liaison for several clients and funds. In his new role, Dan will relocate to London and focus on further embedding and enhancing the use of proprietary, risk-adjusted frameworks and analytics to drive investment conviction across debt and equity strategies in Europe. He will report to both Brian Klinksiek and Philip La Pierre, Head of Europe.

As part of this restructuring, Petra Blazkova has been appointed to the newly created role of Head of Research & Strategy, Core & Core-Plus Capital, Europe. Previously Managing Director within LaSalle’s European Research & Strategy team, Petra was responsible for overseeing Continental European market analysis from the London office. In her new capacity, she will relocate to Munich and work closely with David Ironside, fund manager of Encore+, and Uwe Rempis, fund manager of LaSalle E-REGI, as well as the firm’s separate accounts, supporting the funds’ ongoing strategies and development.

Completing these changes, Dominic Silman has been appointed as Head of Research & Strategy, Debt & Value-Add Capital, Europe. Previously Senior Strategist within LaSalle’s European Research & Strategy team, Dominic will continue to be based in the London office and will work directly with Michael Zerda, Head of Debt & Value-Add Strategies, on the firm’s European debt strategies and recently reconstituted value-add platform. In their new roles, Petra and Dominic will report into Dan Mahoney.

Brian Klinksiek, incoming Global Head of Research & Strategy at LaSalle Investment Management, said: “The breadth and depth of our European Research & Strategy team enables LaSalle to drive forward its best-in-class client offering across Europe. These appointments will help maintain that momentum, underpinning our growing and integrated product mix, and ensuring the ongoing success of LaSalle’s commingled funds and separate accounts. I look forward to continuing to work with Dan, Petra and Dom as the European Research & Strategy team goes from strength to strength”.

Philip La Pierre, Head of Europe at LaSalle Investment Management, added: “Dan, Petra and Dom’s collective experience will be key to our in-house market-leading intelligence and the delivery of competitive investment performance across the full spectrum of our products. They will play a vital role in informing investment decisions and portfolio construction, particularly as we continue to diversify our asset allocation, grow our value-add strategies and build upon our well-established debt series.”

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $82 billion of assets in private equity, debt and public real estate investments as of Q2 2022. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com, and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

Heightened geopolitical risk, persistent high inflation, and a possible recession will place European real estate under acute pressure in H2 2022. However, the asset class is expected to continue to provide longer-term stability for core investors via carefully curated portfolios, as well as offering new opportunity for investors seeking value-add returns – according to the mid-year 2022 edition of the Investment Strategy Annual (“ISA”), the report published by global real estate investment manager LaSalle Investment Management (“LaSalle”).

Europe is facing a macroeconomic environment rendered fragile by supply chain issues, a hot war on the region’s periphery and a squeeze on consumers’ disposable incomes. As a result, LaSalle expects real estate investors to adopt a much more cautious approach in the second half of 2022. However, while inflationary pressures have surged, and interest rates have increased earlier and more quickly than expected, real estate assets can act as a hedge against inflation in cases where landlords have pricing power. Fundamentally, this will manifest for investors with the best assets in the right locations, where supply-demand imbalances underpin rental growth.

Furthermore, in an uncertain environment, investors seeking higher returns can expect to benefit from dislocation and opportunities to repurpose assets. Off-market or value-add opportunities could potentially offset the effect of rising operating expenses, construction costs and interest rates, either through building-specific renovation or repositioning to achieve occupancy improvement or rental uplift.

Long-term resilience will be underpinned by careful stock selection. Although European real estate markets have been impacted by global headwinds, pockets of opportunity persist for investors across each sector.

Retail rebound postponed

In retail, the post-Covid recovery has been shaken by the impact of inflation on consumer discretionary spending power. Bricks-and-mortar retail warehouses have, however, remained resilient due to the non-discretionary nature of underlying demand for grocery anchors and their convenience offer. But fundamental challenges for European shopping centres and high-street retail is expected to persist, despite destination shopping continuing to remain an integral part of the retail experience in the long term. We remain optimistic on the outlook for outlet centres, which are set to benefit from increasing consumer frugality.

Office sector ‘trifurcation’

As with retail, the office sector is experiencing occupier and investor needs varying greatly by the quality of asset and micro location. Experientially rich buildings in prime locations that meet sustainability standards and benefit from high-quality amenities will continue to attract demand. In addition, with the pathway to Net Zero Carbon in mind, the age and quality of existing stock in European markets presents an opportunity to create the offices of the future, particularly through refurbishment. However, there is a growing range of older stock which is likely to be stranded and should be sold at – or at times even below – current valuation before liquidity dries up.

Logistics demand story remains intact

Logistics has not been immune to recent market shocks and the ongoing cost-of-living crisis. A slowdown in take-up by major occupiers marks a change from many years of continued expansion. However, LaSalle believes that the sector remains in a robust position to grow in the coming months. European logistics properties recorded the highest demand for new space ever in H1 2022, driven by continuous e-commerce expansion, as well as just-in-case inventories and the nearshoring of some manufacturing activity. As a result, vacancy rates are at historical lows, and we remain confident of future prospects for European logistics rental growth.

Living strategies’ prospects at risk of divergence

The living sectors remain underpinneD by strong demand drivers including robust household formation, growth in key cities, an ageing population, increasing mobility and a structural undersupply across Europe. However, potential home buyers may tilt toward renting, owing to the rising cost of debt. For the more niche living sub-sectors, such as student housing and senior housing, investors will need to be ahead of the curve to take advantage of attractive pricing.

Finding value across the yield spectrum

With the European landscape evolving quickly, assessing the prospect for various sectors requires consideration of assets’ pricing yield levels and income growth potential.

LaSalle’s framework finds that for low-yield sectors with excellent fundamentals, like logistics, prime low-carbon offices in key cities and unregulated residential, valuations will hinge on the potential for and relative magnitude of future rental growth and an upward shift in yields. In low-yielding sectors where inflation cannot be offset by rental growth, caution must be exercised until markets stabilise.

Although higher-yielding sectors with challenged fundamentals are intuitively those in which value may be identifiable, recent concerns around economic growth have made their impact felt. The nascent retail recovery, for instance, is at risk from inflationary pressure on real incomes, while capex-intensive strategies to renovate buildings are affected by rising construction costs. Meanwhile, sectors with relatively higher yields and stronger net operating income growth potential – namely alternative living sectors, such as student accommodation or senior living – continue to remain attractive.

Brian Klinksiek, Head of European Research and Global Portfolio Strategies at LaSalle, said: “The past six months have seen macroeconomic headwinds and geopolitical risk affect the global economic outlook. European investors should therefore exercise caution in the coming months until market valuations and asset pricing stabilise. But despite this, real estate will remain an anchor as other asset classes struggle, and investors look for predictability. Underpinned by the long-term resilience of the asset class, careful portfolio construction across the key sectors of European real estate can continue to deliver the benefits of diversification, stability and long-term income growth for investors.”

Jacques Gordon, Global Head of Research and Strategy at LaSalle, added: “Real estate generally provided shelter during the waves of volatility that swept through the securities markets in the first half of the year. In the second half, we foresee different dynamics unfolding. The big change has been the sharp rise in inflation in Western countries and a “regime shift” from highly accommodative to tightening monetary policies by several central banks. Many world events simultaneously contributed to this inflection point including: the re-opening of economies after COVID-19, Russia’s invasion of Ukraine, trade wars, and government stimulus spending. Although these pressures were building in 2021, there is no escaping the fact that the financial and commodity markets shifted sharply in the first half of 2022. Our guidance for investors to seek inflation protection in real estate is a focus-theme of our mid-year update.”

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $82 billion of assets in private equity, debt and public real estate investments as of Q2 2022. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

Market direction and economic outlooks have shifted since the start of 2022, with elevated inflation, slowing economic growth, and higher interest rates impacting the real estate market. According to LaSalle’s 2022 Mid-Year Investment Strategy Annual (“ISA”), the overall market shifts are causing real estate investors to re-visit earlier strategies as they understand and react to higher inflation, the Fed’s and the Bank of Canada’s rapid interest rate increases to combat it, and global geopolitical and economic upheaval.

LaSalle clients can view the full report at: www.lasalle.com/research-and-insights/isa-2020

In North America, the impacts of inflation and rising rates on real estate are nuanced, and require an understanding of each sector’s fundamentals, which the report explores. Coming into 2022, LaSalle Research & Strategy noted that the pandemic and its ensuing economic ripple effects had accelerated pre-pandemic trends, widening the gap between favored and non-favored property types. The mid-year report shows these trends are continuing as investors gravitate to favored property types with strong underlying fundamentals. Looking ahead, there is uncertainty in the market, but it appears as though the favored property types are well-positioned to withstand a potential economic slowdown.

Jacques Gordon, Global Head of Research and Strategy at LaSalle, said: “Real estate generally provided shelter during the waves of volatility that swept through the securities markets in the first half of the year. In the second half, we foresee different dynamics unfolding. The big change has been the sharp rise in inflation in Western countries and a “regime shift” from highly accommodative to tightening monetary policies by several central banks. Many world events simultaneously contributed to this inflection point including: the re-opening of economies after COVID-19, Russia’s invasion of Ukraine, trade wars, and government stimulus spending. Although these pressures were building in 2021, there is no escaping the fact that the financial and commodity markets shifted sharply in the first half of 2022. Our guidance for investors to seek inflation protection in real estate is a focus-theme of our mid-year update.”

Select 2022 Mid-Year ISA findings for North America include:

- In line with the full-year ISA’s prediction, favored property types including industrial, multifamily, medical office and single family rentals continue to have strong fundamentals and outperform on a relative basis. Industrial development and transactions continue as there remains a supply gap and businesses who lease these spaces continue to show they can continue to pay rents, even as they increase. The residential property types also have a strong outlook. As interest rates rise and inflation impacts housing starts, many would-be homebuyers may look to rent.

- The debt markets remain liquid, providing the capital needed to finance transactions. While the Mid-Year ISA expects a slowdown in transactions, debt funds, life insurance companies and banks continue to lend to strong, established sponsors. Meanwhile, CMBS issuance has slowed, and higher interest rates mean highly leveraged borrowers are less competitive bidders for property. For borrowers, leverage is less accretive than last year, but many are still using leverage with the belief that future income growth will make leverage accretive to returns over their hold period.

- The report also looks at capital flows as barometer of market health, and notes that NAV REITs continue to raise capital, as retail investors start to establish a portfolio allocation to real estate and diversify amid a volatile market environment. While many closed-end funds still have dry powder from previous capital raises, new institutional capital raises appear to have slowed slightly as established investors have reached their target allocations after playing catchup over the last several years.

- Transaction volume in the first quarter of the year was higher than the first quarter of the prior year. US transaction volume last quarter was $157.6 billion, 76 percent higher than a year ago. In Canada, USD $10.7 billion traded in last quarter, representing a 71 percent year-over-year increase. The report estimates that pricing has adjusted downward from a peak in the first quarter of 2022 by a range of 0-15 percent depending on market segment, giving back a portion of the gains from the last 12 months. Though second quarter data is not yet available, anecdotally it seems transactions have slowed amidst shifting pricing and broader uncertainty. However, a bid-ask gap has not developed as buyers and sellers have been willing to accept similar price declines.

Rich Kleinman, Americas Co-CIO and Head of US Research & Strategy at LaSalle, said, “While it remains to be seen how inflation and interest rates will evolve in the second half of the year, it is our view that many property types are well-positioned to support investor goals in the months ahead, and that real estate exposure should play a productive role in investors’ portfolios. Experience in recent downturns is also helping investors and lenders navigate the uncertainty, which should bode well for the industry as a whole.”

Chris Langstaff, Head of Research and Strategy for Canada at LaSalle, said, “Canada is historically a stable market, and it appears that while many of the same headwinds apply, fundamentals remain strong and transactions in many property types are moving forward.”

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $82 billion of assets in private equity, debt and public real estate investments as of Q2 2022. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

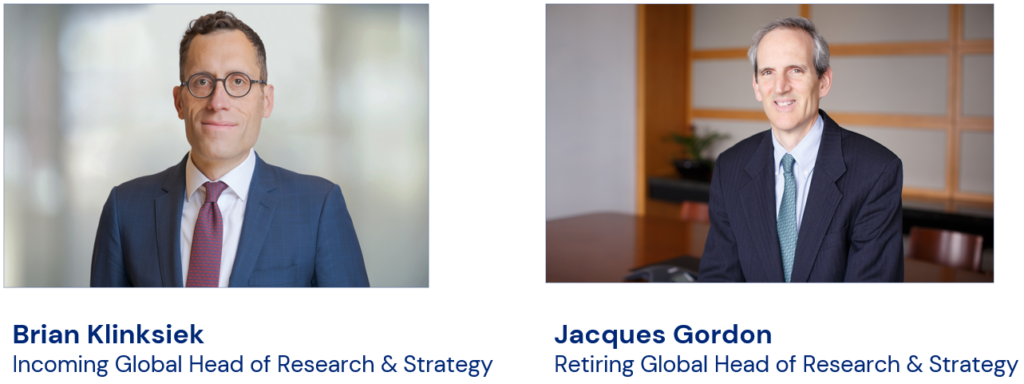

LaSalle Investment Management (“LaSalle”) today announced that after 28 years of distinguished service and leadership of the Research & Strategy group at the firm, Jacques Gordon has confirmed he will retire from the business at the end of 2022 in to order pursue interests in higher education. He will remain as the Global Head of Research & Strategy through the remainder of this year, and will be succeeded by Brian Klinksiek, LaSalle’s current Head of European Research & Global Portfolio Strategies, effective 1 January 2023.

Brian will continue to be based in London and will join LaSalle’s Global Management committee, reporting to CEO Mark Gabbay. Succession for Brian’s Head of European Research & Strategy role is in process and will be announced prior to his transition to global leadership in 2023.

LaSalle Global CEO Mark Gabbay said, “This transition reflects LaSalle’s continued focus on thoughtful leadership succession, offering both continuity along with fresh ideas to be infused across the organization. We are grateful for the numerous contributions Jacques has provided LaSalle and the broader industry over the course of his career, and look forward to recognizing these accomplishments in the months ahead. Brian’s professional experience positions him well to take on this role, having lived, worked, and covered the real estate markets in North America, Europe and Asia-Pacific.”

After joining LaSalle in 2020, Brian led the reorganization of LaSalle’s European Research & Strategy team from a geography-focused model to a more dynamic pan-European sector-focused model. He has deepened the Research & Strategy team’s integration within the firm’s newly formed European Debt & Value-add platform, and also led the creation of LaSalle’s global investment risk management function. Brian has been a leading industry advocate for the incorporation of climate risk analysis into investment-making decisions, and is a champion for diversity in the workplace, having been appointed Chair of LaSalle’s European Culture of Care committee in 2021.

Brian Klinksiek, incoming Global Head of Research & Strategy said, “It is an honor to be named the next leader of LaSalle’s world-class Research & Strategy team. Jacques has done a remarkable job establishing LaSalle’s reputation for timely insights, accurate forecasts, and impactful strategy that is fully integrated with the investment process. He has been a role model for me throughout my career – even before I joined the firm. I am thankful for his guidance and partnership, and look forward to continuing to seek his counsel as he moves into academia.”

Jacques Gordon, retiring Global Head of Research & Strategy said, “I am grateful for the experiences, insights and friendships I’ve gained during my time at LaSalle. Our Global Research & Strategy team is well-positioned to continue to deliver great value to our clients and investment colleagues around the world, and Brian is the right leader to drive the next phase of innovation and growth. I look forward to seeing the firm prosper as I transition to the next chapter of my career.”

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $82 billion of assets in private equity, debt and public real estate investments as of Q2 2022. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LaSalle Investment Management (“LaSalle”) has appointed Rosanna Phillips as Managing Director in its Debt Investments team and Kevin Kong as Director of Acquisitions for Value-Add Investments, adding to the continued growth and expansion of LaSalle Debt & Value-Add Strategies in Europe.

Based in London, Rosanna brings extensive legal experience in commercial real estate transactions. Most recently, she was General Counsel at Intriva Capital, an investment firm focused on asset-backed special opportunities in Western Europe. In that role, she was responsible for overseeing legal matters in relation to the business including legal advice, risk evaluation, structuring and execution. Prior to that, Rosanna spent over 10 years at Linklaters, with a particular focus on European real estate finance, and was seconded to LaSalle in that role.

Kevin joins LaSalle with over 12 years of real estate investment experience. Most recently, he served in UBS Asset Management’s Multi-Managers Real Estate group as a Director, where he led coverage of non-fund investments such as JVs, co-investments and fund formations. Prior to this, Kevin spent eight years at Meyer Bergman, most recently as Senior Vice President for acquisitions, where he was responsible for value-add transactions across Europe. Kevin began his career at Citibank London within the EMEA Real Estate & Lodging team.

Michael Zerda, Head of Debt & Value-Add Strategies at LaSalle, said: “The addition of Rosanna and Kevin brings a wealth of experience and market knowledge to our growing business, and we are pleased to welcome them to LaSalle. We are excited to continue to build our European debt and value-add equity investing capabilities as we deliver value for our investors.”

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $82 billion of assets in private equity, debt and public real estate investments as of Q2 2022. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

No results found

LaSalle Investment Management (“LaSalle”) will develop Munich’s first hybrid timber office building, in collaboration with ACCUMULATA Real Estate Group (“ACCUMULATA”). The building is being constructed on behalf of Encore+, LaSalle’s flagship pan-European fund.