FOR INTENDED INSTITUTIONAL INVESTORS ONLY – NOT FOR GENERAL PUBLIC DISTRIBUTION

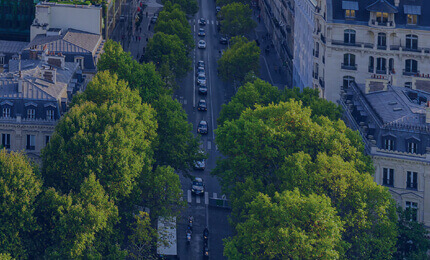

LaSalle Encore+’s pan-European, location-based strategy is centered around investing in desirable assets in the places where people live, work, shop, and play, both today and into tomorrow.

-

€ 0b

GAV

-

€ 0b

NAV

-

0

properties

-

0-star

GRESB rating

As of June 30, 2024; assets in euros. Returns may increase or decrease as a result of exchange rate fluctuation. Please see information regarding GRESB ratings at the bottom of this page.

As a core plus fund, LaSalle Encore+ aims to provide investors with consistent capital growth and stable, long-term income returns. The Fund was designed with the aim of providing attractive, risk-adjusted returns and a reliable income stream.

The Fund’s core team of 10 investment professionals is supported by a wider team of over 100 individuals* overseeing transactions, finance, investor relations, tax, legal and compliance across LaSalle’s six European offices.

Why invest?

Long-term thinking

The Fund management team’s long-term thinking has provided robust returns over the life of the fund, which has spanned both the Global Financial Crisis of 2008 and the Covid-19 pandemic. Please note that past performance does not predict future returns.

Diversity for income security

LaSalle Encore+’s assets are diversified across all major property sectors with the aim of providing reliable income.

Active asset management

Our asset management team plays a key role in our strategy to generate returns for the LaSalle Encore+ portfolio. By overseeing improvements to the Fund’s assets, they seek to mitigate downside risk and aim to unlock income and value.

Strategic investment approach

The LaSalle Encore+ team works hand-in-hand with our research colleagues, whose recommendations and insights help to develop the Fund’s investment strategy.

For a full description of the risks associated with investing in the Fund, please refer to the “Summary of Risks” the offering memorandum.

Sustainability

Every day, the LaSalle Encore+ team works to improve the long-term environmental performance of the Fund’s assets. We work closely with tenants to understand their energy needs and help them meet their own commitments.

By working together to improve energy efficiency, lower emissions and capture resources such as sunlight and rainwater, we’re working to improve performance today and build a better tomorrow.

Explore the LaSalle Encore+ portfolio

Office

Office

Trí, Munich

Two prime office buildings in Munich’s vibrant Westend

Industrial

Industrial

Isle d’Abeau, France

A new-build asset located along France’s “logistics backbone” with good access to population centers in three countries

Industrial

Industrial

Tigery, Lyon

A new-build logistics warehouse southeast of Paris with access to the A5 Autoroute and the Francilienne (Paris ring road)

No results found

The LaSalle Encore+ team

No results found

LaSalle Encore+ news

No results found

Important information

This webpage is for informational purposes and to give a general overview of LaSalle Investment Management. This webpage does not constitute an offer to sell, or the solicitation of an offer to acquire any interests in any collective investment vehicle, arrangement, entity, joint venture, club, separate account mandate or for the advisory services of LaSalle Investment Management or its affiliates. Should an interest in any of the foregoing be offered by LaSalle Investment Management or the services of LaSalle Investment Management be made available, then such offer or services will only be made available following the registration, authorization, license or other form of notification pursuant to the rules of the relevant country being obtained or otherwise satisfied. You are responsible for obtaining your own legal and tax advice in respect of any investment.

Notice to recipients in the EU: With effect from the fund being registered for “marketing” pursuant to the provisions of Directive 2011/61/EU of the European Parliament and of the Council of 8 June 2011 on Alternative Investment Fund Managers (as amended), this webpage constitutes a “marketing communication” for the purpose of the “Guidelines on marketing communications under the Regulation on cross-border distribution of funds” (effective 2 February 2022) as issued by the European Securities and Markets Authority pursuant to Article 4(6) of Regulation (EU) No 345/2019). Please refer to the offering memorandum and management regulations of the Fund before making any final investment decision.

The Fund is actively managed.

Important information about sustainability and the LaSalle Encore+

A decision to invest in the Fund should consider all characteristics or objectives disclosed in the offering document. Please refer to the offering memorandum and management regulations of the Fund before making any final investment decision.

Except where specified either in this webpage or any other documents, any ESG or impact goals, targets, commitments, incentives, initiatives or outcomes referenced in any information, reporting or disclosures published by LaSalle are not being marketed to investors or promoted and do not bind any investment decisions made in respect of, or the management or stewardship of, any funds managed by LaSalle for the purposes of Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector. Any measures in respect of such ESG or impact goals, targets, commitments, incentives, initiatives or outcomes may be overridden, may not be implemented or may not be immediately applicable to the investments of any funds managed by LaSalle (in each case, at LaSalle’s sole discretion).

LaSalle Encore+ received a GRESB rating in October 2023, covering the period from January to December 2022. LaSalle pays a membership fee to GRESB.

Sustainable Finance Disclosure Regulation (SFDR)

If you are an investor or prospective investor in LaSalle Encore+, please log in to the Investor Portal or Dataroom to access the SFDR disclosures. If you do not have access, please Contact Us.

In accordance with its offering memorandum, the LaSalle Encore+ properties are valued monthly on RICS International Valuation Standards basis by Cushman & Wakefield and CBRE.

Important information about LaSalle Encore+’s portfolio of assets

The assets presented are meant for illustrative purposes only, are subject to change without notice and are not meant as a projection or estimate of the nature of any future investments to be made by the Fund or returns on any such investments. This information has been prepared by LaSalle in order to illustrate the type of assets held and/or transactions completed by the Fund; transactions for properties exhibiting the same or similar characteristics may not be available or profitable in the future.