FOR INTENDED INSTITUTIONAL INVESTORS ONLY – NOT FOR GENERAL PUBLIC DISTRIBUTION

The LaSalle Property Fund invests in and manages a portfolio of diversified high-quality core real estate assets in major markets across the US in the industrial, multifamily, office, retail and niche sectors.

-

$ 0b

GAV*

-

$ 0b

NAV

-

0%+

occupancy rate**

-

0-star

GRESB rating***

As of December 31, 2024; assets in US dollars. Returns may increase or decrease as a result of exchange rate fluctuation. *Includes real estate assets as well as all other property and Fund level assets such as cash and receivables. **Occupancy rate reflects operating investments, as defined by NCREIF, and is weighted by gross asset value at the Fund’s ownership share. ***Please see information regarding GRESB ratings at the bottom of this page.

The LaSalle Property Fund’s investment management team is based in Chicago and supported by an extensive asset management team based in offices across the United States. Together they are focused on delivering value and maximizing long-term returns for clients.

Why invest?

Over a decade of performance

Since its inception in 2010, the LaSalle Property Fund has focused on creating and managing a portfolio with an emphasis on property types with strong growth potential and lesser risk of disruption from secular changes.

A diverse portfolio of assets

The Fund’s assets are diversified across major and niche property sectors in major American markets, aiming to provide reliable returns, even when markets stumble. Compared to the OCDE Index, the Fund has longer average leases, higher exposure to emerging sectors such as medical offices and less asset concentration.

Active asset management

LaSalle’s asset management team plays a key role in our strategy to generate returns in the Fund’s portfolio of assets. By suggesting and managing improvements to the buildings the Fund owns, they seek to mitigate downside risk and unlock income and value.

Strategic investment approach

The Fund’s Investment Managers work hand-in-hand with LaSalle’s Research and Strategy Team, helping to develop the LaSalle Property Fund’s investment strategy and make sound transactional decisions.

For a full description of the risks associated with investing in the Fund, please refer to the “Summary of Risks” in the offering memorandum.

Sustainability

The LaSalle Property Fund’s commitment to strong sustainability principles is exhibited both at the fund and firm level. The Fund has earned a three-star GRESB rating, while LaSalle has committed to reaching net zero carbon by 2050.

The Fund actively pursues energy, water, and waste efficiency initiatives to reduce its environmental impact and pursues sustainability certifications across the portfolio. And in helping investors meet their own sustainability goals, we aim to realize both superior performance and a better tomorrow.

Explore the LaSalle Property Fund portfolio

Residential

Residential

Legacy at Highlands Ranch

A high-quality, garden-style apartment community in suburban Denver

Retail

Retail

San Jose Marketcenter

A purpose-built retail center in a highly sought-after retail area.

Niche

Niche

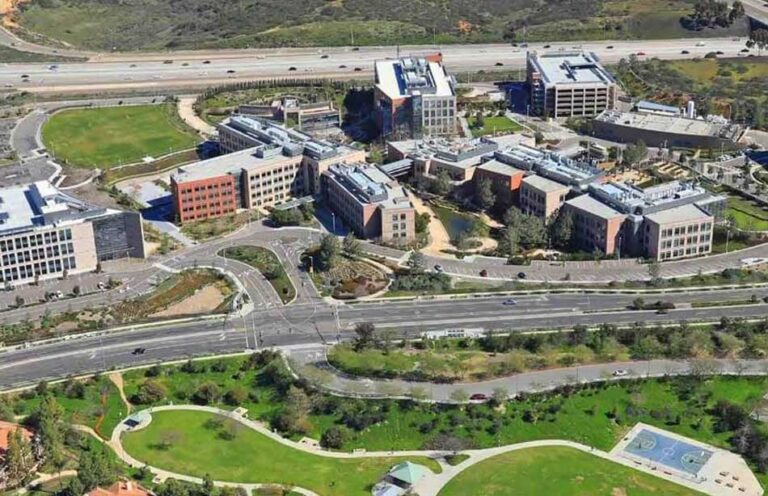

Illumina, San Diego

A partial interest in a world-class life sciences facility

Niche

Niche

Memorial Hermann Medical Plaza

A 28-story medical office building in the world’s largest healthcare complex.

Niche

Niche

Self-storage portfolio

Self-storage facilities in areas of high demand

No results found

The LaSalle Property Fund team

No results found

LaSalle Property Fund news

No results found

Important information

This webpage is for informational purposes and to give a general overview of LaSalle Investment Management. This webpage does not constitute an offer to sell, or the solicitation of an offer to acquire any interests in any collective investment vehicle, arrangement, entity, joint venture, club, separate account mandate or for the advisory services of LaSalle Investment Management or its affiliates. Should an interest in any of the foregoing be offered by LaSalle Investment Management or the services of LaSalle Investment Management be made available, then such offer or services will only be made available following the registration, authorization, license or other form of notification pursuant to the rules of the relevant country being obtained or otherwise satisfied. You are responsible for obtaining your own legal and tax advice in respect of any investment.

Notice to recipients in the EU: With effect from the fund being registered for “marketing” pursuant to the provisions of Directive 2011/61/EU of the European Parliament and of the Council of 8 June 2011 on Alternative Investment Fund Managers (as amended), this webpage constitutes a “marketing communication” for the purpose of the “Guidelines on marketing communications under the Regulation on cross-border distribution of funds” (effective 2 February 2022) as issued by the European Securities and Markets Authority pursuant to Article 4(6) of Regulation (EU) No 345/2019). Please refer to the offering memorandum of the Fund before making any final investment decision.

LaSalle Property Fund is part of the NCREIF ODCE Index, and this index is used as a reference point for the Fund’s performance. The Fund is actively managed.

Important information about sustainability and the LaSalle Property Fund

A decision to invest in the Fund should consider all characteristics or objectives disclosed in the offering document. Please refer to the offering memorandum of the Fund before making any final investment decision.

Except where specified either in this webpage or any other documents, any sustainability or impact goals, targets, commitments, incentives, initiatives or outcomes referenced in any information, reporting or disclosures published by LaSalle are not being marketed to investors or promoted and do not bind any investment decisions made in respect of, or the management or stewardship of, any funds managed by LaSalle for the purposes of Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector. Any measures in respect of such sustainability or impact goals, targets, commitments, incentives, initiatives or outcomes may be overridden, may not be implemented or may not be immediately applicable to the investments of any funds managed by LaSalle (in each case, at LaSalle’s sole discretion).

LaSalle received a GRESB rating in October 2024, covering the period from January to December 2023. LaSalle pays a membership fee to GRESB.

Sustainable Finance Disclosure Regulation (SFDR)

If you are an investor or prospective investor in LaSalle Property Fund, please log in to the Investor Portal or Dataroom to access the SFDR disclosures. If you do not have access, please Contact Us.

Important information about the LaSalle Property Fund’s portfolio of assets

The assets presented are meant for illustrative purposes only, are subject to change without notice and are not meant as a projection or estimate of the nature of any future investments to be made by the Fund or returns on any such investments. This information has been prepared by LaSalle in order to illustrate the type of assets held and/or transactions completed by the Fund; transactions for properties exhibiting the same or similar characteristics may not be available or profitable in the future.