FOR INTENDED INSTITUTIONAL INVESTORS ONLY – NOT FOR GENERAL PUBLIC DISTRIBUTION

LaSalle manages a series of closed-end funds that seek to provide attractive risk-adjusted returns in US real estate.

-

0

closed funds

-

0+

years of experience

-

0+

transactions

-

$ 0b

transaction volume

Assets in US dollars; data as of September 30, 2024; returns may increase or decrease as a result of exchange rate fluctuation.

The value-add strategy is focused on repositioning non-stabilized, emerging or transitional real estate across the United States into stable, cash-flowing assets that appeal to a wide range of long-term buyers. The specialist team has successfully closed eight previous funds and have over 25 years of experience across property sectors in major US markets.

Why invest?

Multi-sector exposure

The US value-add team focuses on building diversified portfolios of assets where user demand is the strongest, but supply is insufficient: residential, industrial, life science and medical office. They are able to pivot with changing market conditions.

Dedicated team, meaningful alignment

The US value-add team is comprised of over 15 professionals who are dedicated solely to the value-add investing platform. To ensure alignment of interest, LaSalle employees co-invest in the strategies.

Active asset management

LaSalle’s Asset Management team plays a key role generating returns in the portfolio of assets. They create value through repositioning assets, managing risk-mitigated ground-up development and executing portfolio aggregation strategies, with the vast majority of acquisitions conducted on an off-market basis.

Strategic, research-based approach

The ability to harness and synthesize information is key to the success of the US value-add investments team. They regularly draw on the expertise of LaSalle’s data-driven, in-house Research and Strategy team, who are actively involved in advising on strategy and investment decisions.

For a full description of the risks associated with investing in any opportunity, please refer to the “Summary of Risks” in the relevant offering memorandum.

Sustainability

LaSalle recognizes that ESG factors, when properly applied, can positively influence investment performance. We tailor our approach to each fund and each asset, working to protect and enhance financial returns today and in the future. We are proud to have achieved a score of A+ from the UN PRI for both strategy and governance and property. We have also committed to being a net zero carbon firm by 2050.

By capturing more data on energy efficiency, emissions and other metrics such as resource capture and community benefits, we’re tracking our improvements. In helping investors meet their own sustainability goals, we aim to realize both superior performance and a better tomorrow.

The LaSalle value-add investments team, United States

No results found

LaSalle US value-add investment news

No results found

Important information

This webpage is for informational purposes and to give a general overview of LaSalle Investment Management. This webpage does not constitute an offer to sell, or the solicitation of an offer to acquire any interests in any collective investment vehicle, arrangement, entity, joint venture, club, separate account mandate or for the advisory services of LaSalle Investment Management or its affiliates. Should an interest in any of the foregoing be offered by LaSalle Investment Management or the services of LaSalle Investment Management be made available, then such offer or services will only be made available following the registration, authorization, license or other form of notification pursuant to the rules of the relevant country being obtained or otherwise satisfied. You are responsible for obtaining your own legal and tax advice in respect of any investment.

Important information about sustainability

A decision to invest in any investment opportunity should consider all characteristics or objectives disclosed in the offering document. Please refer to the offering documents relating to the relevant investment opportunity before making any final investment decision.

Except where specified either in this webpage or any other documents, any ESG or impact goals, targets, commitments, incentives, initiatives or outcomes referenced in any information, reporting or disclosures published by LaSalle Investment Management are not being marketed to investors or promoted and do not bind any investment decisions made in respect of, or the management or stewardship of, any funds managed by LaSalle Investment Management for the purposes of Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector. Any measures in respect of such ESG or impact goals, targets, commitments, incentives, initiatives or outcomes may be overridden, may not be implemented or may not be immediately applicable to the investments of any funds managed by LaSalle Investment Management (in each case, at LaSalle’s sole discretion).

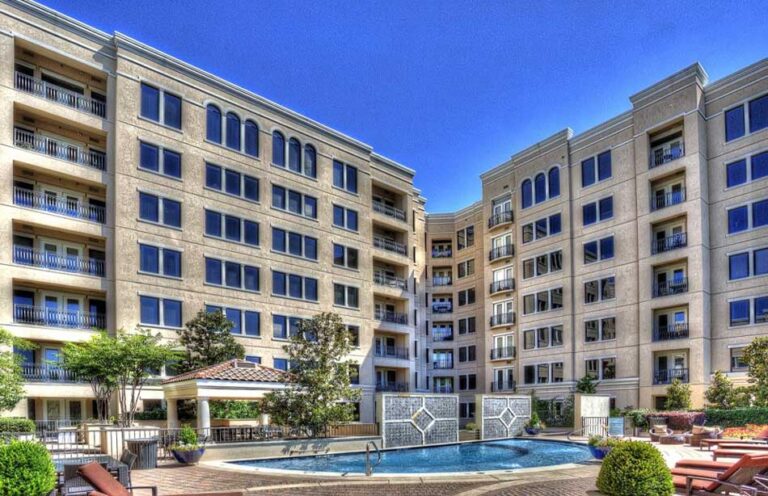

Important information about US value-add assets

The assets presented are meant for illustrative purposes only, are subject to change without notice and are not meant as a projection or estimate of the nature of any future investments, or returns on any such investments, to be made by LaSalle Investment Management. This information has been prepared by LaSalle Investment Management in order to illustrate the type of assets previously held and/or transactions completed by LaSalle Investment Management; transactions for properties exhibiting the same or similar characteristics may not be available or profitable in the future.