-

Chicago (November 18, 2024) – LaSalle Investment Management (“LaSalle”), the global real estate investment manager, is pleased to announce the appointment of Tara McCann as Head of Americas Investor and Consultant Relations, effective November 4. In this role, Tara leads LaSalle’s efforts to strengthen relationships with existing institutional investors, enhance consultant relationships and expand the firm’s network across the Americas.

Tara’s appointment reinforces LaSalle’s commitment to continually strengthen its investor relations capabilities as well as to diversify product offerings and broaden distribution channels in the Americas to drive long-term growth. Based in New York, she reports to Samer Honein, Global Head of Investor Relations. Tara will assume the responsibilities of Adam Caskey, Head of Americas Investor Relations, who is set to retire in December this year.

Tara is a real estate industry veteran with over 25 years of experience in senior roles across investor relations, product development, acquisitions, and investment banking. She joins LaSalle from Rockwood, where she served as Head of Capital and Client Strategies, while also spearheading the firm’s ESG initiatives. Prior to that, Tara was a Managing Director with USAA Real Estate Company, serving as the product specialist for opportunistic and credit strategies. She has also held senior roles at H/2 Capital Partners, Ranieri Real Estate Partners and the Deutsche Bank Securities’ Real Estate Investment Banking Group.

Tara received a Master of Business Administration in Finance from Columbia Business School and a Bachelor of Arts in Economics and Urban Studies from Brown University.

Samer Honein, Global Head of Investor Relations at LaSalle, added: “Tara’s experience in investor relations, product development and strategic insights across the real estate industry make her an ideal addition to the team. We look forward to her leadership of our Americas investor relations efforts, reinforcing our commitment to deliver world-class partnerships to our clients.”

Brad Gries, Head of Americas at LaSalle, commented: “Tara’s appointment is a key step in our strategy to enhance our coverage and product offerings in the Americas. Her deep industry knowledge and established relationships will be instrumental as we continue to deliver innovative solutions to meet the evolving needs of our investors in the region.”

Tara McCann, Head of Americas Investor and Consultant Relations at LaSalle said: “I am excited to join a firm with LaSalle’s values and global platform at this exciting time of growth. I look forward to expanding our relationships and continuing LaSalle’s legacy of delivering innovative solutions that meet the evolving needs in real estate investment of our partners.”

ENDS

About LaSalle Investment Management | Investing Today. For Tomorrow.

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages US$84.8 billion of assets in private and public real estate equity and debt investments as of Q2 2024. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles, including separate accounts, open- and closed-end funds, public securities and entity-level investments.

For more information, please visit www.lasalle.com, and LinkedIn.

Company news

Feb 27, 2019 Investing in Asia Pacific real estate in an environment of rising volatility and uncertainty 2 min read According to LaSalle Investment Management’s Investment Strategy Annual (ISA) 2019, the fundamental drivers of real estate occupier markets are likely to retain their “just right” status in 2019.

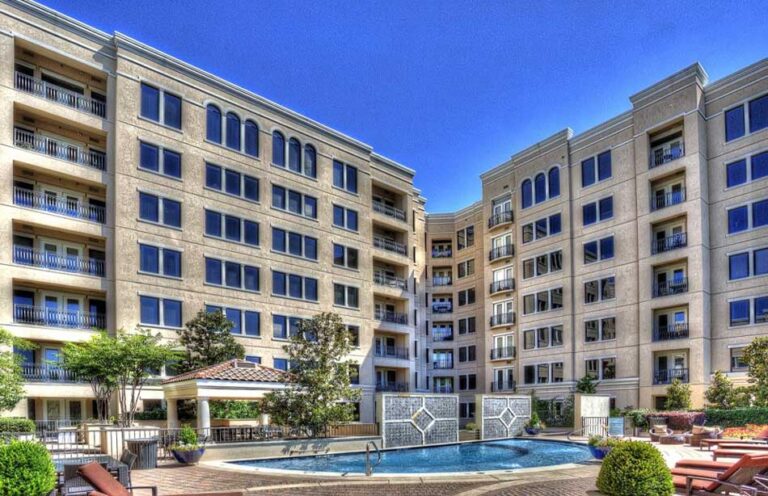

Feb 27, 2019 Investing in Asia Pacific real estate in an environment of rising volatility and uncertainty 2 min read According to LaSalle Investment Management’s Investment Strategy Annual (ISA) 2019, the fundamental drivers of real estate occupier markets are likely to retain their “just right” status in 2019. Feb 22, 2019 LaSalle Acquires Value-Add Multifamily Asset in Dallas 4 min read LaSalle Investment Management (“LaSalle”) today announced that its U.S. value-add fund, LaSalle Income & Growth Fund VII (“Fund VII”), has acquired Rienzi at Turtle Creek, a 152-unit high-rise rental apartment community in the affluent Turtle Creek submarket of Dallas, Texas.

Feb 22, 2019 LaSalle Acquires Value-Add Multifamily Asset in Dallas 4 min read LaSalle Investment Management (“LaSalle”) today announced that its U.S. value-add fund, LaSalle Income & Growth Fund VII (“Fund VII”), has acquired Rienzi at Turtle Creek, a 152-unit high-rise rental apartment community in the affluent Turtle Creek submarket of Dallas, Texas. Feb 19, 2019 LaSalle contracts €1.6 billion in commercial real estate transactions in Continental Europe 3 min read LaSalle announces that the value of its actively managed assets under management in Continental Europe has risen to €7 billion, representing a year-on-year net increase of €1 billion.

Feb 19, 2019 LaSalle contracts €1.6 billion in commercial real estate transactions in Continental Europe 3 min read LaSalle announces that the value of its actively managed assets under management in Continental Europe has risen to €7 billion, representing a year-on-year net increase of €1 billion.No results found