-

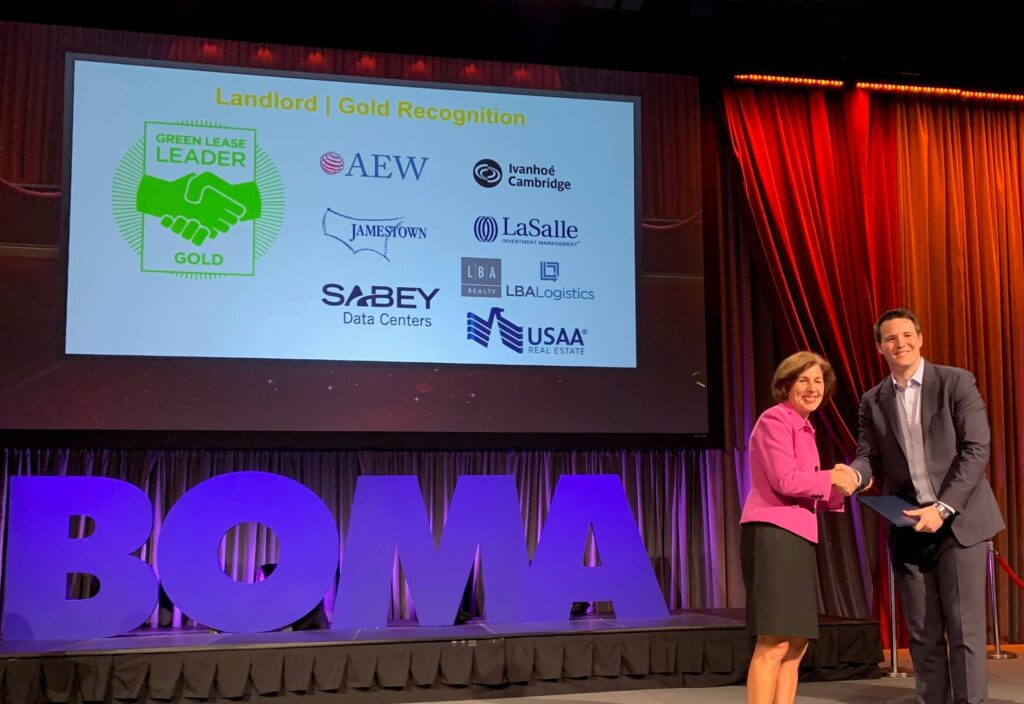

LaSalle Investment Management (“LaSalle”) was named a Gold-level Green Lease Leader at the BOMA International Conference in Salt Lake City, Utah, an annual event that brings together thousands of commercial real estate professionals to share the latest industry trends and operational best practices.

Established six years ago by the Institute for Market Transformation (IMT) and the U.S. Department of Energy’s Better Buildings Alliance, Green Lease Leaders helps identify and recognize leading-edge companies and real estate practitioners who break down barriers to high-performance buildings by revolutionizing the lease to incorporate energy efficiency and sustainability. Green leases, also known as “energy-aligned” leases, create mutually beneficial agreements for building owners and tenants by equitably aligning the costs and benefits of energy and water efficiency investments for both parties.

The Green Lease Leaders Gold designation is awarded to organizations that exhibit a strong commitment to sustainability in buildings and best practice leasing. LaSalle was recognized as a Gold-level award winner for building upon its silver-level achievement last year and executing leases with sustainability clauses at multiple assets across its U.S. portfolio.

Eric Duchon, Global Head of Sustainability at LaSalle, commented: “We are pleased at the substantial progress made within our U.S. portfolio to achieve the Gold-level Green Lease Leaders designation. Integrating sustainability clauses within our leases is a critical asset-level strategy to engage with our tenants and further implement ongoing ESG initiatives. We remain committed to enhancing our sustainability practices and measurements concurrent to our focus on achieving strong investment performance on behalf of our clients.”

This achievement adds to LaSalle’s track record of ESG best practices and distinctions. Industry organizations continue to recognize LaSalle for ESG leadership and maintaining its distinction as an employer of choice. LaSalle has received the following U.S. and global awards in the past year:

- 2019 ENERGY STAR® Partner of The Year Award

- GRESB, UN Principles for Responsible Investment, Task Force on Climate-Related Financial Disclosure

- 2018 Green Lease Leaders Award

- Energy Star Charter Tenant

- P&I Best Places to Work in Money Management

Cliff Majersik, Executive Director for the Institute for Market Transformation (IMT), added: “Each year, it becomes more important for commercial landlords and tenants to use every available tool and strategy to improve building performance to stay in step with the changing landscape of climate change action and competitive real estate markets throughout the U.S.

“A green, high-performance lease is an incredibly effective tool to help landlords and tenant companies achieve significant win-win business, energy, and health benefits that are good for the real estate industry, good for cities, and good for the air we breathe. IMT and the Department of Energy’s Better Buildings Alliance are proud to honor the 2019 Green Lease Leaders at this year’s BOMA Annual Conference & Expo, and we congratulate them for joining the wave innovative firms that are taking energy efficiency and sustainability in leased properties to the next level.”

This year, Green Lease Leaders represented portfolios totalling more than 501 million square feet, bringing the cumulative floor area of all Green Lease Leaders to over 2 billion square feet of building space – an indication green leasing is a real estate trend that will continue to grow as a best practice across markets.

Standard commercial leases have historically been a roadblock to more efficient buildings because they create a split incentive where one party reaps the benefits of investing in building upgrades. A green lease agreement guarantees that environmental measures are collaboratively taken by landlords and tenants, and it acts as a catalyst and safeguard for achieving win-win goals and savings for both parties. Green lease clauses can address a range of efficiency improvements that not only help landlords and tenants lower operating expenses, but also increase return on investment, comply with city and state building performance laws, and enable more healthy spaces that are attractive to employees and customers.

An IMT study has shown that green leases have the potential to reduce utility bills by up to $0.51 per square foot (11-22 percent) in office buildings alone, and, if all leased office buildings executed green leases, the U.S. office market alone could save over $3 billion in annual cost savings.

For more information on the Green Lease Leaders program and this year’s recipients, visit greenleaseleaders.com.

About LaSalle Investment Management

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, we manage approximately $77 billion of assets in private equity, debt and public real estate investments as of Q4 2021. The firm sponsors a complete range of investment vehicles including open- and closed-end funds, separate accounts and indirect investments. Our diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. For more information please visit www.lasalle.com and LinkedIn.

NOTE: This information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

Mar 01, 2019 Tekka Place Marks Structural Completion with Topping Out Ceremony in Singapore 5 min read Tekka Place, an upcoming hospitality-and-retail integrated development comprising a ten-storey main block and seven-storey annex block with rooftop deck at 2 Serangoon Road, is on schedule for completion by the end of the year.

Mar 01, 2019 Tekka Place Marks Structural Completion with Topping Out Ceremony in Singapore 5 min read Tekka Place, an upcoming hospitality-and-retail integrated development comprising a ten-storey main block and seven-storey annex block with rooftop deck at 2 Serangoon Road, is on schedule for completion by the end of the year. Feb 27, 2019 Investing in Asia Pacific real estate in an environment of rising volatility and uncertainty 2 min read According to LaSalle Investment Management’s Investment Strategy Annual (ISA) 2019, the fundamental drivers of real estate occupier markets are likely to retain their “just right” status in 2019.

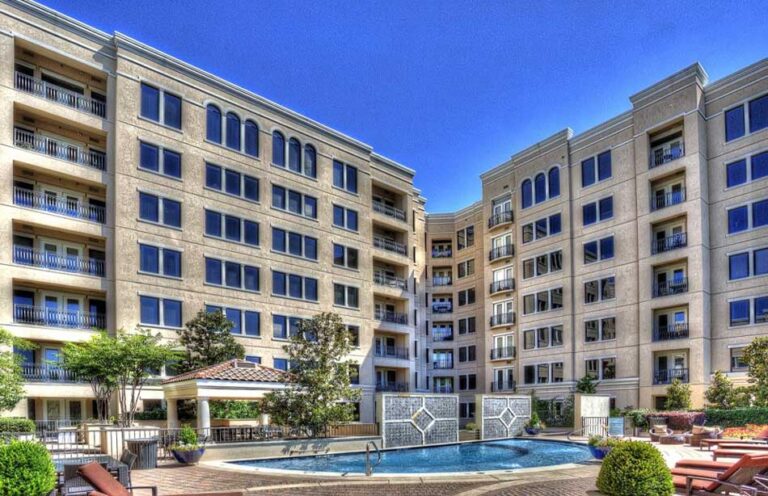

Feb 27, 2019 Investing in Asia Pacific real estate in an environment of rising volatility and uncertainty 2 min read According to LaSalle Investment Management’s Investment Strategy Annual (ISA) 2019, the fundamental drivers of real estate occupier markets are likely to retain their “just right” status in 2019. Feb 22, 2019 LaSalle Acquires Value-Add Multifamily Asset in Dallas 4 min read LaSalle Investment Management (“LaSalle”) today announced that its U.S. value-add fund, LaSalle Income & Growth Fund VII (“Fund VII”), has acquired Rienzi at Turtle Creek, a 152-unit high-rise rental apartment community in the affluent Turtle Creek submarket of Dallas, Texas.

Feb 22, 2019 LaSalle Acquires Value-Add Multifamily Asset in Dallas 4 min read LaSalle Investment Management (“LaSalle”) today announced that its U.S. value-add fund, LaSalle Income & Growth Fund VII (“Fund VII”), has acquired Rienzi at Turtle Creek, a 152-unit high-rise rental apartment community in the affluent Turtle Creek submarket of Dallas, Texas.No results found