-

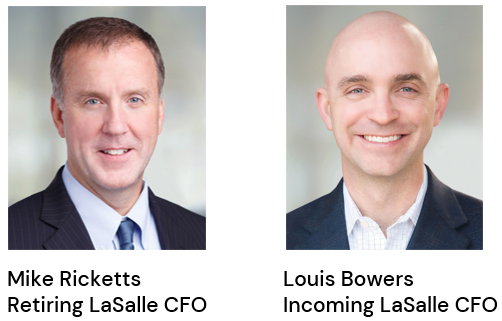

CHICAGO, LONDON, SINGAPORE (Oct. 10, 2023) — LaSalle Investment Management (“LaSalle”) today announced that after 34 years of distinguished service and leadership of the firm’s global finance group, CFO Mike Ricketts will retire in Q2 2024. He will remain CFO through year-end 2023, and effective January 1, 2024, will be succeeded by Louis Bowers, current Global Head of Financial Planning & Analysis (FP&A) for JLL. Mike and Louis will work closely in the coming months to ensure continuity and a smooth transition of responsibilities.

LaSalle CEO Mark Gabbay said, “Mike’s contributions and leadership at the firm cannot be overstated. Beyond his technical expertise, transparency and consistent drive to improve the business, Mike’s respect for others and collegial nature helped establish LaSalle’s award-winning culture. He is one of a kind, and we wish him the best on his well-deserved retirement. We look forward to Louis joining LaSalle in this global leadership role, and the benefit of his experience and connection to the broader JLL business.”Louis joined JLL in September 2014 and served as the Global Controller and Principal Accounting Officer from August 2015 until December 2021. During this period, he oversaw JLL’s accounting policies, external reporting, Sarbanes-Oxley compliance and adherence to applicable regulatory requirements. He also helped the organization navigate through many complex aspects of change, ranging from adopting new accounting standards to integrating significant M&A volume.

Since December 2021, Louis has been Global Head of FP&A, during which he has helped lead JLL’s efforts to pivot its reporting segments to global business lines and implement a new standardized cost allocation methodology. During this tenure, Louis has also been responsible for the company’s budgeting and forecasting processes, periodic financial reporting to senior leadership and the Board of Directors, and providing ongoing support for the company’s quarterly earnings. Prior to joining JLL, Louis served in various positions at Retail Properties of Americas, Inc, a multi-tenant retail REIT, as well as member of KPMG’s audit practice.

Louis Bowers, incoming LaSalle CFO said, “I am eager to join LaSalle in this important global finance role. I have enjoyed and admired working alongside Mike over the years, and look forward to working with the teams around the world to optimize our financial performance in the years ahead.”

Mike Ricketts, retiring LaSalle CFO said, “I am grateful for my time and experience working at LaSalle. The growth and prosperity of the firm is a result of our people, and Louis is the right leader to advance our finance segment in the next phase of growth. I look forward to working with him in the months ahead, and tracking the continued success of the firm in the future.”

About LaSalle Investment Management | Investing Today. For Tomorrow

LaSalle Investment Management is one of the world’s leading real estate investment managers. On a global basis, LaSalle manages approximately $78 billion of assets in private and public real estate property and debt investments as of Q1 2023. LaSalle’s diverse client base includes public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from across the globe. LaSalle sponsors a complete range of investment vehicles including separate accounts, open- and closed-end funds, public securities and entity-level investments. For more information, please visit http://www.lasalle.com, and LinkedIn.

Forward looking statement

The information discussed above is based on the market analysis and expectations of LaSalle and should not be relied upon by the reader as research or investment advice regarding LaSalle funds or any issuer or security in particular. The information presented herein is for illustrative and educational purposes and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy in any jurisdiction where prohibited by law or where contrary to local law or regulation. Any such offer to invest, if made, will only be made to certain qualified investors by means of a private placement memorandum or applicable offering document and in accordance with applicable laws and regulations. Past performance is not indicative of future results, nor should any statements herein be construed as a prediction or guarantee of future results.

Company news

Jan 30, 2025 LaSalle and Deeley Freed obtain planning permission for Bristol shopping centre redevelopment Located on Gough Street, the asset will benefit from excellent rail, bus and tram links and help address the undersupply of student housing in the market.

Jan 30, 2025 LaSalle and Deeley Freed obtain planning permission for Bristol shopping centre redevelopment Located on Gough Street, the asset will benefit from excellent rail, bus and tram links and help address the undersupply of student housing in the market. Jan 28, 2025 LaSalle provides a £100m loan for Apollo’s 699-bed PBSA asset, Pavilion Court, in Wembley Located on Gough Street, the asset will benefit from excellent rail, bus and tram links and help address the undersupply of student housing in the market.

Jan 28, 2025 LaSalle provides a £100m loan for Apollo’s 699-bed PBSA asset, Pavilion Court, in Wembley Located on Gough Street, the asset will benefit from excellent rail, bus and tram links and help address the undersupply of student housing in the market. Jan 10, 2025 LaSalle provides a £68.7 million green loan for Vita’s 540-bed PBSA scheme in central Birmingham Located on Gough Street, the asset will benefit from excellent rail, bus and tram links and help address the undersupply of student housing in the market.

Jan 10, 2025 LaSalle provides a £68.7 million green loan for Vita’s 540-bed PBSA scheme in central Birmingham Located on Gough Street, the asset will benefit from excellent rail, bus and tram links and help address the undersupply of student housing in the market.No results found