-

This article first appeared in February 2024 edition of the BAI Newsletter

For debt providers, the relative risk adjusted return profile for new real estate credit today is very attractive. Higher interest rates have helped to improve the return profile, and new loan detachment points are generally trending lower, particularly in instances where borrowers are willing to show support for underlying assets and commit additional cash to a transaction.

These attractive fundamentals for lenders were largely in place last year too, however transaction volumes across new acquisitions and refinancings were limited for a variety of reasons. By contrast, in 2024 we expect to see robust demand for debt financing solutions provided by real estate investment funds. This is due to both recent market developments and longer-term structural trends. In the shorter term, borrowers have begun to adapt to a higher cost of financing. This comes as no surprise given the dynamics behind the rapid increase in interest rates that abruptly ended 15 years of historically low rates. With the borrowing market adapting to this new environment, and with interest rates expected to stabilize and start to decline, we have also seen transactions start to move forward at the start of 2024. It is expected that debt will again become a common component of sponsors’ business plans in 2024.

In the longer term, the migration of commercial real estate lending activity away from banks and towards debt funds has been a dominant theme over the past 15 years. The long-running Bayes Business School study of UK CRE lending* found that, in the first half of 2022, debt funds exceeded domestic banks’ new originations for the first time.

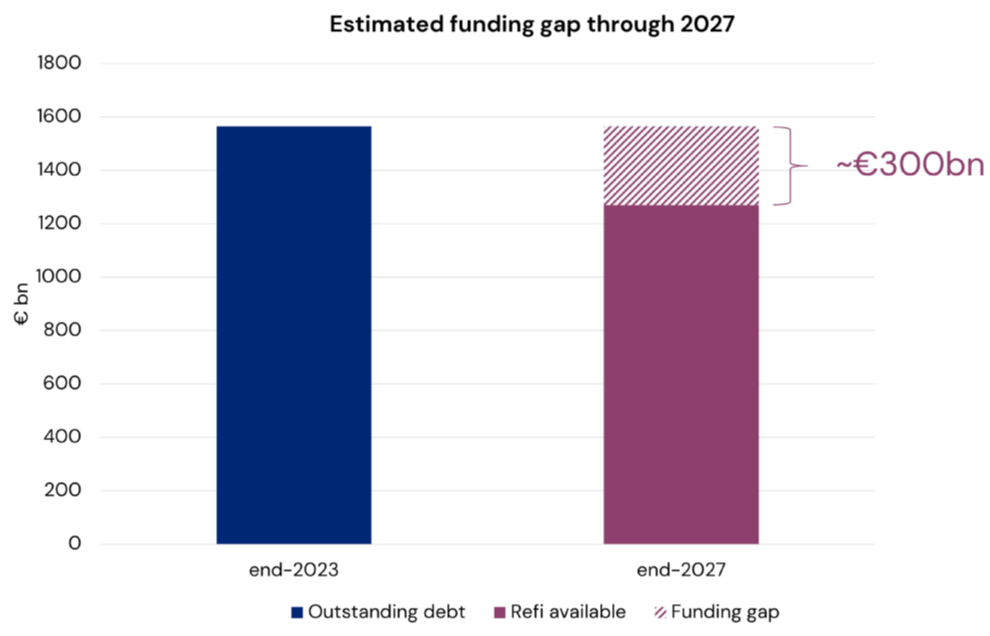

Alternative lenders are poised to further expand their market share in the coming years. Bayes Business School estimates demand for real estate finance in Europe at €310 billion per year, and the current stock of outstanding real estate debt at €1.6 trillion. However, as underlying values have declined and loan-to-value ratios (LTVs) are down, traditional lenders may only be willing to advance around €1.3 trillion of the capital necessary to refinance loans maturing through 2027.

Source: MSCI Real Capital Analytics, Bayes Business School, CBRE, JLL, LaSalle (01/24).

Notes: Past performance is not indicative of future results. There is no guarantee that any trends shown herein will continue or that any forecasts shown herein will materialize as expected. Funding gap estimates based on Bayes Business School assessment of debt outstanding and maturing annually, and LaSalle forecasts of capital value change.Funds will therefore encounter a significant volume of investment as they play an ever-increasing role in addressing the real estate financing gap, created by banks’ ongoing retrenchment and the considerable quantities of debt falling due for refinancing in the short run.

Despite these attractive dynamics for non-bank real estate lenders, this remains a market with potential for real dispersion in performance between fund managers. Delivering attractive risk-adjusted returns for investors will require several crucial ingredients, including having a well-resourced platform across all facets of the business that is established in the market and leveraging analytical tools to negotiate with borrowers.

The benefits of an established market presence and platform

For alternative lenders to remain competitive, they must be able to offer sponsors a wide range of capital solutions. The flexibility afforded by a variety of debt structures should help borrowers transition to a higher-rate environment, allocate risk to where it is most suitably borne and ensure that good-quality properties continue to have access to liquidity.

In other words, both debt funds and borrowers benefit from differentiated pockets of debt capital, ranging from senior lending, whole loans, levered whole loans and mezzanine, including development and refurbishment financing. Borrower demand for bespoke financing solutions makes this an attractive environment in which to be active and to deploy capital across a diverse range of market opportunities.

As a lender, a natural complement to this diversity of investment strategies is a wider geographic scope. The ability to deploy capital across borders and across currencies further enhances funds’ ability to be selective.

Structuring is also critical, particularly when underwriting risk for assets that traditional lenders are less willing to finance. Appropriately managing risk while offering more structured solutions, utilizing a range of protections such as standard loan covenants or business plan targets are all measures that help align interests between borrowers and lenders.

Scalability also plays a critical role in a lender’s ability to remain competitive in today’s environment. – While refinancing needs can be met by more traditional senior-mezzanine lending structures, an increasingly prevalent structure sees a whole loan provided by an alternative lender. The whole loan provider provides a single counterparty and point of contact for a borrower to work with, while allowing for more certainty as well as enhanced control for the lender. This combination of a flexible investment mandate, cross-border presence and a robust approach to underwriting and deal structuring is fundamental to striking the right balance between supporting borrowers and protecting investors’ capital. These attributes will naturally be found in those established players with a proven track record of transacting and who can offer certainty and speed of execution.

Those same funds will also disproportionately be those with access to a wider asset management platform, also to borrowers’ benefit.

Ultimately, a collaborative real estate debt investment manager will not be extending loans with the express intention of eventually taking over or outright owning the assets. But being part of a large platform with asset management capabilities is not just an important safety net in the event that a restructuring and transfer of ownership does take place. It also helps pre-empt and avoid that situation. Drawing on those asset management capabilities means that lenders can identify red flags in a deal early-on, and in turn work with their borrowers and help provide insight into ways to maximise value.

Leveraging wider analytical tools

As detailed in LaSalle’s ISA Outlook 2024, we also believe that, to lend successfully in a challenging market, debt providers need to maintain a targeted approach, effectively sourcing transactions by scrutinising market data and making use of local market presence.

Tapping into a wider pool of analytical tools, data and longer-term outlooks is invaluable when working with borrowers and understanding their commercial horizons. For example, in the absence of comparable transactions to act as reference points for how certain asset valuations have rebased, the ability to conduct price discovery by analysing, understanding, and underwriting fundamentals from the point of view of an equity sponsor is key.

In some instances, fresh borrower equity is required to support elongated business plans. To that end, fostering a good relationship with borrowers by working with their reformulated business plans is fundamental to unlocking the right structured financing solutions, especially in the face of forthcoming debt maturities. In a market impacted by rising interest rates and geopolitical convulsions, finetuning capital requirements quickly can be only undertaken by a real estate manager with the capabilities and resources to conduct that deep analysis.

Good data is also important when seeking to invest across a range of different real estate assets. Currently, lender appetite is focused on sectors with especially strong occupier fundamentals, and their ability both to capture rental growth in line with inflation and to access relatively liquid capital markets. Logistics, residential, student and select operational sectors, such as hospitality, are widely considered to offer resilient fundamentals. This is resulting in a reasonable degree of liquidity for originating new financings in those preferred sectors, but insight remains crucial to picking both markets and sponsors with the capabilities to access such growth. More importantly and particularly in scenarios whereby strong occupational trends are obvious, it is still critical to understand cost structure, and ultimately capital markets in an environment where very little transaction data exists. Access to good quality data is a key component of determining underlying value of an asset in today’s environment.

Outside of those preferred sectors with a more obvious path to cash flow, the traditional sectors of offices and retail have been most challenged. That is especially true for offices outside of prime CBD, whereby a large amount of uncertainty exists, arising from the cloud of uncertainty surrounding future occupier demand and what the impact on capital markets over the long run will be. Data-led insights and a proprietary view on whether, how and where the office market will recover is therefore an important advantage for lenders. For example, ESG credentials are increasingly important as a key determinant of asset performance in the office sector. Wellness, energy efficiency, sustainability accreditations – all of these are metrics that need to be analysed to forecast occupier demand, and in turn, valuation trends.

Opportunities and challenges for 2024

Since the global financial crisis, commercial real estate lending has evolved towards a diverse pool of capital providers which includes both more traditional banks, but also debt funds. In 2024, this trend is expected to continue.

Despite the scope for funds to earn more market share this year, lenders face many potential pitfalls. When it comes to origination, sourcing financing opportunities will require a focus on parts of the market where supply and functionality has lagged societal trends. These situations enable rental growth at or above inflation, aligning with what individual and corporate occupiers want from their spaces. Likewise, credit selection and structuring will require a keen eye on lending basis and coverage levels, alongside the underlying real estate capabilities of the sponsors.

Real estate credit is currently a highly attractive asset class. But to ensure that both fund investors and borrowers are being served well requires a debt platform that can provide a variety of leverage solutions, tap into a rich bank of data/analytics, and draw on insights from a wider bench of real estate specialists, all underpinned by a market-leading team with exceptional borrower relationships. Those are the characteristics that investors and borrowers alike should prioritise in their partners.

*From 2018, The UK Commercial Real Estate (CRE) Lending Survey is based at Bayes Business School, City, University of London. The Survey is a unique and comprehensive record of CRE lending, and an industry standard source of information, regularly referenced in the national financial press and trade publications: https://www.bayes.city.ac.uk/ faculties-and-research/centres/real-estate/bayes-cre-lending-report. Up to 2017, the study was published by De Montfort University, Leicester.

Nov 19, 2024

ISA Outlook 2025

Shifting interest rates, dynamic occupier fundamentals, deepening bifurcation within sectors: how should real estate investors respond?