-

Brian Klinksiek and Fred Tang on China’s great reopening means for property markets in China and around the world. What it means for Chinese and global property markets

After nearly three years of enforcing a comprehensive approach to COVID-19, involving frequent testing, rigorous contact tracing and strict border quarantines, China unexpectedly ended its zero-COVID policy in early December 2022.

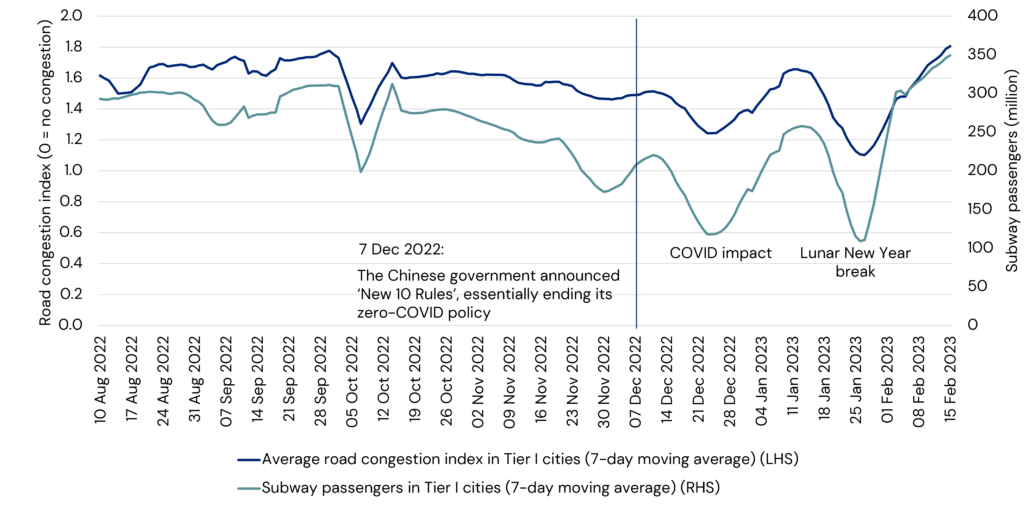

After an initial period of surging new infections, by mid-January 2023 the situation had improved substantially. Most recently, cases have fallen sharply as the virus has already infected a large share of the population. Life in China is quickly returning to normal, as evidenced by rebounding subway passenger volume and rising road congestion.1 This return to pre-pandemic normality has meaningful implications for the economic and real estate outlook in China, the broader Asia-Pacific region and the world.

Road congestion and subway passenger volume in Tier I cities in China

1 Source: Amap.com via WIND Economic Database (road congestion index), WIND Economic Database (subway passenger volume), as of 15 Feb 2023)

China: Unambiguously positive for growth

China’s reopening provides a clear boost to the Chinese economy, and high-frequency indicators suggest it may have already started to recover. The official manufacturing PMI and non-manufacturing PMI both returned in January 2023 to above 50, the dividing line between expansion and contraction, after hitting the lowest levels since March 2020 in December 2022.2

Meanwhile, among the 70 cities tracked, 36 experienced increases in for-sale residential prices on a quarterly basis in January 2023, compared with only 15 cities in December 2022.3

Unlike China’s V-shaped recovery from the initial COVID-19 outbreak in 2021, the rebound this time is likely to be gradual and mild. There are two factors supporting that expectation. First, despite the reopening and a shift in government policy towards promoting growth, it could take some time to repair the balance sheets of Chinese businesses and households, which are fragile after nearly three years under the zero-COVID regime. Second, the country’s for-sale residential sector, historically a main driver for the economy, remains weak despite signs of bottoming.

2 National Bureau of Statistics of China (NBS)

3 National Bureau of Statistics of China (NBS)

Asia-Pacific: Outbound travel likely to be key

Looking to the broader Asia-Pacific region, China’s reopening is an encouraging development for the hospitality industry. Since March 2022, hotel revenue per available room (RevPAR) had been gradually improving in countries which were advanced in their post-COVID reopening, particularly Australia and Singapore.4

However, Chinese visitors historically have been a significant source of hotel demand and visitor spending in major Asia-Pacific markets, and they were almost completely absent in 2022. As such, hotel performance in most tourism destinations of the region is still trailing the pre-pandemic level. As China unleashes pent-up demand for travel, a recovery in Asia-Pacific hotel and tourism-oriented retail sectors is likely.

4 The Singapore Tourism Board, The Hong Kong Tourism Board, as of Dec 2022

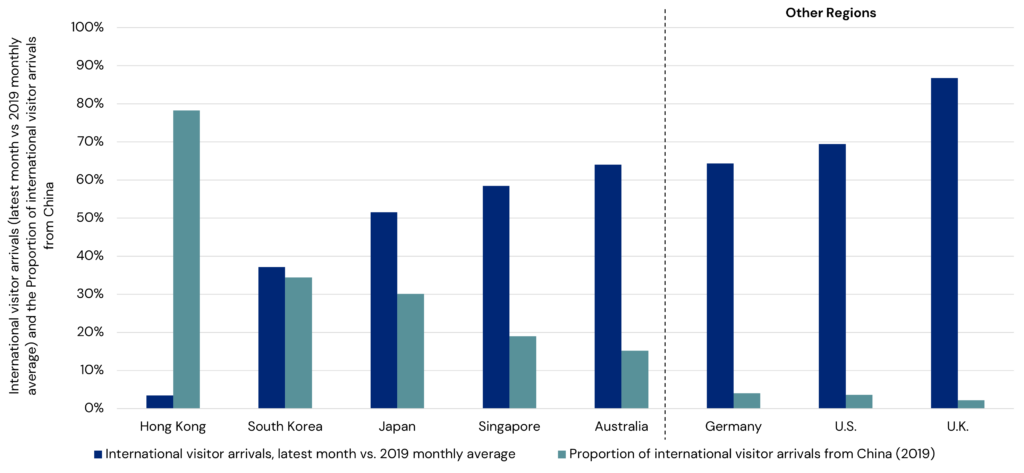

International visitor arrivals and the proportion from China5

5 The latest data on international visitor arrivals to (1) the U.K. are as of September 2022, (2) Australia, Germany, and the U.S. are as of November 2022, and (3) Hong Kong, Japan, Singapore, and South Korea are as of December 2022. The data on the proportion of international visitor arrivals from China for all countries are as of 2019 except Germany which is as of 2018. Source: Statista and CEIC (Germany), as of 2018; the U.K. Office for National Statistics (the U.K.), as of September 2022; the Australian Bureau of Statistics, the U.S. Department of Commerce, as of November 2022; the Hong Kong Tourism Board, the Japan National Tourism Organization; the Singapore Tourism Board; the Korea Tourism Organization, as of December 2022.

Global: Incrementally inflationary or boost to supply chains?

The impact of China’s reopening on the global economy will depend on the interplay of two opposing factors. On the one hand, higher demand from stronger growth in the world’s second-largest economy could potentially increase global inflation, or at least keep it high for some time.

On the other hand, the smoother operation of global supply chains from a fully reopened China is potentially a counterbalancing disinflationary trend. Indeed, an end to the start-stop impact of lockdowns on production and transportation should reduce the risk of further supply chain shortages.

Our expectation of only a gradual recovery in the domestic economy means that the hit to global inflation may not be significant. Weaknesses in the Chinese housing market is likely to prevent too much upward pressure on global construction costs from materializing, even though China is the world’s largest steel exporter. But any boost to inflation, just as it is starting to come down in much of the world, would be unwelcome and could mean that global central banks might not be able to stop raising interest rates as soon as otherwise.

Looking ahead

- The reopening is expected to boost occupier and investor demand for commercial real estate in China. Improving real estate fundamentals and domestic investor sentiment, along with low domestic interest rates and the rapid growth of the domestic public REIT market, points to increasing capital market liquidity among domestic investors for Chinese commercial real estate assets in the near term. The logistics and multifamily rental sectors are expected to benefit from this trend the most due to their relatively sound fundamentals, their qualification for domestic public REIT structures and other supportive government policy measures.6

- In the Chinese culture, the Year of the Rabbit signifies prosperity, peace and longevity. While the world is still facing many challenges including elevated inflation, higher interest rates, the risk of recession and the Russia-Ukraine war, the reopening in China in the Year of the Rabbit brings clear positives to the Chinese economy and its real estate markets, though the risk of a renewed rise in global inflation should be watched carefully.

6 Among the major commercial real estate sectors, currently only industrial and multifamily rental assets are qualified underlying assets for ownership by domestic public REITs.

Want to continue reading?

Nov 19, 2024

ISA Outlook 2025

Shifting interest rates, dynamic occupier fundamentals, deepening bifurcation within sectors: how should real estate investors respond?