-

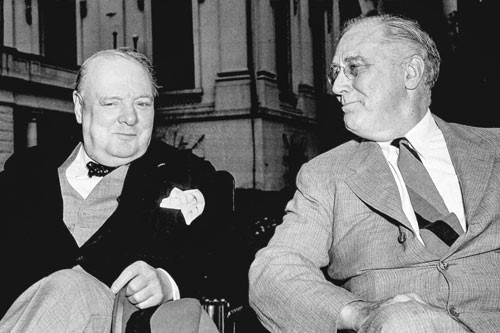

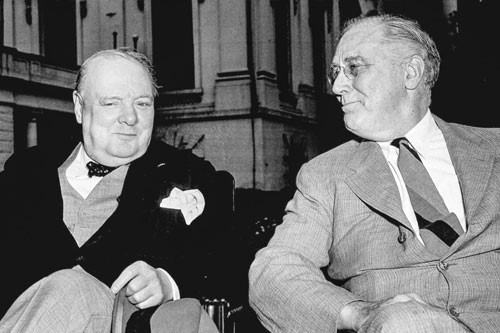

Examining the “special relationship” between the United Kingdom and the United States

The Special Relationship is an unofficial term often used to describe the political, diplomatic, cultural, economic, military, and historical relations between the United Kingdom and the United States. The term first came into popular usage after it was used in a 1946 speech by Winston Churchill. The two nations have been close allies during many conflicts in the 20th and 21st centuries, including World War I, World War II, the Korean War, the Cold War, the Gulf War, and the War on Terror. Both countries were special for the wrong reasons in 2019, as U.S. trade policy and Brexit drove financial and economic uncertainty to high levels. The U.S. engaged in trade skirmishes with many parts of the world, particularly China, raised its military profile in the Middle East, and generally obstructed globalization trends through actions on climate change, immigration and an exit from multi-lateral agreements replaced by unilateral negotiations. To close out the year, the U.S. House of Representatives voted to impeach the President, only the third time in history. The United Kingdom failed to follow through with Brexit for most of the year, leading to the resignation of Prime Minister May and a national election.

Looking ahead to 2020 and 2021, LaSalle’s Investment Strategy Annual forecasts another year in which the U.S. and U.K. play an outsized role in rocking the global boat.

While events in the Anglo-American sphere reflect falling trust in political leadership, the decisions of consumers, business, and investors, by contrast, showed confidence that both markets would eventually muddle through – and, in part, the closing events of the year proved them right. The U.K. is on a clearer Brexit path after a decisive December vote that should push the country to leave the European Economic Union in 2020. The U.S. Congress reached agreement on the USMCA trade agreement and stock indices hit record highs.

The misadventures of the U.S. and U.K. did not derail their long-lived economic expansions or spill over to affect the rest of the world. Global growth in 2019 was between 3 and 4%, and global equities had their best year since 2009 (28% total return). In the U.S., the S&P 500 was up by 31.5% in 2019, the second highest return of the past 23 years, while U.K. equities were up by a solid 18%.

While core private real estate returns were unspectacular in 2019 (6.2% in the U.S. and 2.0% in the U.K.), the story of the past decade is much more positive. Unleveraged core property returns averaged 10% over the past ten years in both countries, remarkably similar to returns from Global Stocks and Global REITs (11% – see p. 6), though with less volatility when looked at over rolling 10-year measurement periods. Canada and Australia – the other countries with long return histories – performed similarly, with trailing 10-year returns of 9% and 10%, respectively. Looking ahead to 2020 and 2021, LaSalle’s Investment Strategy Annual forecasts another year in which the U.S. and U.K. play an outsized role in rocking the global boat. LaSalle foresees a slowing global economy (p. 23), ongoing trade disagreements (p. 12), high asset valuations, and disruptive technology as headwinds to favorable real estate performance. However, many of these same forecasts are also linked to salutary tailwinds. Slow growth is linked to low interest rates (p. 18), which elevates values. High valuations are linked to momentum in capital markets, when investors increase allocations to real estate as a result of strong prior performance (p. 4-6), and disruptive technology is linked to higher productivity and innovation.

Apr 01, 2025

Working backwards: Dealing with unprecedented policy uncertainty

In this period of elevated policy uncertainty, real estate investors should focus on what they can and should do amidst all the noise.