-

This article first appeared in the Fall 2024 edition of PREA Quarterly

Chris Battista, Senior Product Manager at LaSalle Global Solutions, and Brian Klinksiek, Global Head of Research and Strategy, discuss the value of publicly traded real estate investments.

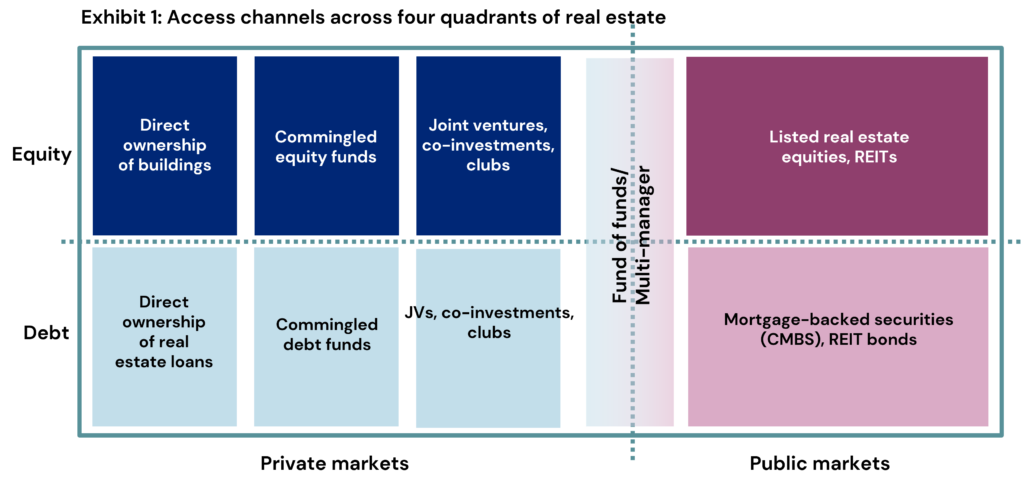

Investors should consider a holistic approach to the real estate asset class across the “four quadrants.” This means considering opportunities spanning both equity and debt positions on one dimension and both private and public market executions on the other (Exhibit 1). Doing so captures the full gross capitalization of real estate, enhances diversification, and opens opportunities to capture the best relative value. We call this being “quadrant smart” in LaSalle’s recently released ISA Portfolio View 2024, an annual report on portfolio construction.

Allocating between real estate debt and equity investing should be driven by risk appetite, views of relative pricing, and an investor’s broader portfolio considerations. Although debt investing has been quite topical over the past two years and covered by multiple investment managers, including LaSalle (see ISA Focus: Investing in Real Estate Debt), this article discusses the relationship between the public and private avenues to real estate equity investment.

Institutional investors tend to be well versed in private equity real estate investing but less consistent in their approach to the publicly traded side of real estate—even though the public side offers similar characteristics, a broad opportunity set, and often leading signals on the broader market’s direction. This article focuses on how to think about using both sides of the equity real estate investing coin, public and private, to maximize access and potentially improve the overall risk-adjusted return profile.

Want to read more?

Mar 04, 2025

Why US real estate debt?

Craig Oram and Alexandra Levy discuss the reasons why investors are increasing allocations to US real estate debt.