-

This article first appeared in the Summer 2024 edition of PREA Quarterly

LaSalle’s Global Head of Research and Strategy, Brian Klinksiek, discusses how ex-US investors are viewing the US real estate market.

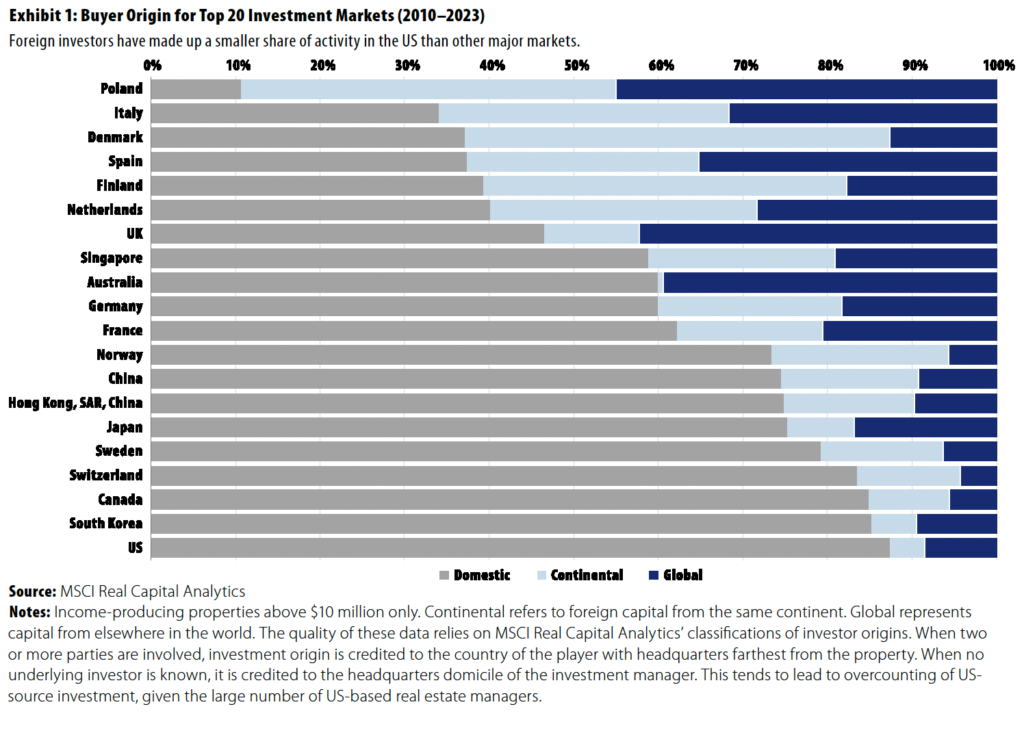

Foreign investors are an important—if far from dominant—source of capital for US commercial real estate. Since 2010, foreign investors have made up around 12% of total US investment activity, compared with the 30%–60% range for most other major developed markets, according to MSCI Real Capital Analytics (Exhibit 1). However, foreign investors also play a meaningful role as limited partners in funds. According to the PREA Investor Composition Survey, investors from outside the US in 2022 held nearly 18% of the NCREIF Fund Index—Open End Diversified Core Equity (NFI-ODCE) net asset value, a share that has risen steadily from less than 5% in 2012. Moreover, in some phases of the market, offshore capital has acted as the marginal buyer of certain types of real estate, giving an outsize impact on pricing.

Investors broaden their real estate holdings outside their home countries for many reasons, including to diversify, expand the opportunity set, and avoid crowded capital markets at home. The drive to expand globally is especially strong for investors in countries with excess savings in the form of well-funded defined benefit pension systems (e.g., Northern Europe), mandatory retirement savings programs (superannuation in Australia), or sovereign wealth funds (many energy exporters). LaSalle has long been an advocate of “going global”; while not the focus of this article, LaSalle covers the case for global investing in its ISA Portfolio View report.

Want to read more?

Jul 01, 2025

PERE: Q&A with Global CEO Mark Gabbay

LaSalle’s Global CEO sat down with PERE to discuss the world’s simplest, most complicated asset class.