-

(L-R) LaSalle’s Brian Klinksiek, Rich Kleinman and Jen Wichmann discuss migration trends and urbanization in the US. In the past decade, the urbanization narrative in the United States has shifted from the “rebirth of cities” to the “rise of the suburbs.”1 What are the drivers of this shift, and how does it impact real estate? In this ISA Briefing, we tackle these questions and share our outlook for how future dynamics could impact migration and urbanization trends.

Demographics is destiny

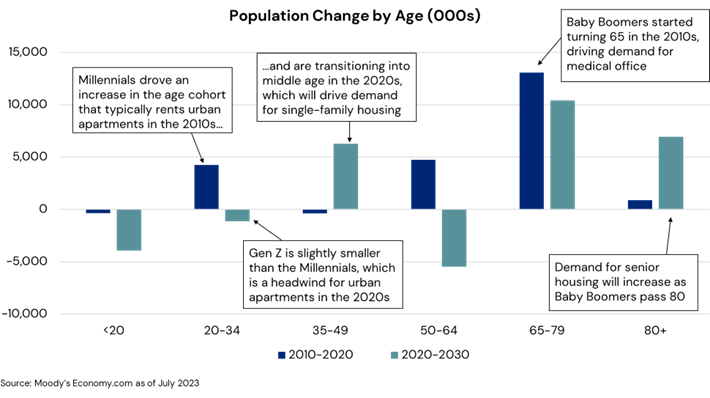

Demographic cohort effects are a key driver of the current shift. The generic, or median, location preferences of a cohort change as that cohort ages; as the relative growth of different age groups ebbs and flows it impacts the national trend towards urban and suburban location preference.

In the US, there are two outsized cohorts, the Baby Boomers and the Millennials, which as they age have a disproportionate impact on national averages (see chart below). In the early 2010s, the bulk of the Millennial cohort was in their 20s, and as young adults they had a preference for living in urban locations. In the present decade the same cohort is aging into their 30s and 40s, entering a life stage that tends to prefer living in suburban locations. Young families move to the suburbs to seek more space and because the local school funding system in the US tends to mean suburban schools are better funded. This shift began in the latter half of the 2010s as the older members of the cohort reached their mid-30s but was accelerated by the Covid-19 pandemic in 2020.

Sunbelt supremacy

Regional shifts also accelerated in the late 2010s as migration to the southern Sunbelt markets increased,2 driven in part by households moving in search of more affordable living and warmer weather compared to northern cities. While in-migration to high-cost metros slowed throughout the 2010s, and eventually turned negative, inflows to Sunbelt metros accelerated through 2016 before slowing because of lower international immigration. This also contributed to a national shift toward suburban living because Sunbelt metros such as Houston, Dallas, Atlanta and Phoenix lack the dominant central city with a strong central business district that is characteristic of older cities like New York, Boston, Chicago and Washington, DC.

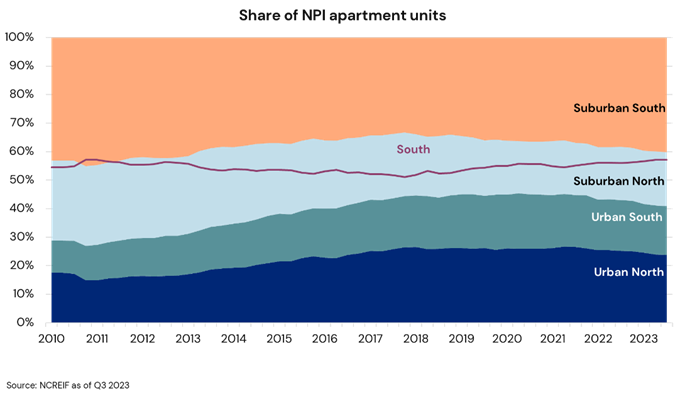

As these Sunbelt metros grew faster, it led to a shift in the mix of apartments nationally towards suburban locations. This is shown in the NCREIF Property Index (NPI) data in the chart below. It shows that the NPI’s share of apartments in the south has increased since 2018; the same time when the share of suburban apartments started reversing the gains achieved in urban apartment share in the 2010s. (This analysis is done based on unit count, so is not driven by trends in relative values.)

Post-pandemic realities

The pandemic not only accelerated the urban and regional shifts already underway, but it set into motion a new set of forces that influence where households choose to live. The enduring popularity of remote work requires more space for a home office, which is cheaper in the suburbs, and commuting only a couple days per week makes living further from city centers more palatable. Owners of suburban apartments and shopping centers have benefitted as a result.

Conversely, having fewer downtown workers has hurt office values and urban retail, and the reduction in activity is a contributor to the increase in crime that has occurred in urban areas. Although violent crimes have come down after a pandemic-era spike, theft and property crimes increased in 2022 according to the FBI.3 Both types of crime remain significantly below the highs of the early 1990s, but public awareness seems elevated relative to the hard data. The crime issue extends into city neighborhoods as well, which can motivate some residents to move out of the city.

Evidence of an urban rebound

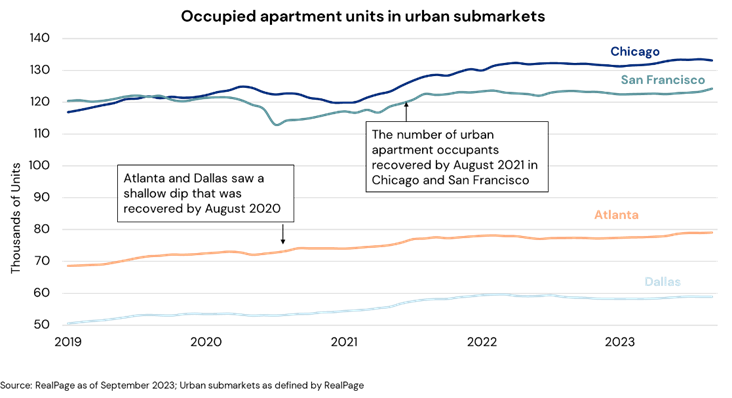

Despite the challenges, residents returned to urban areas as the pandemic receded. Chicago and San Francisco saw the number of occupied units in urban submarkets4 decline 4.0% and 7.4% from peak to trough during the early days of the pandemic.5 But they have since recovered; as of September 2023, Chicago had 6.6% more occupied units in urban submarkets compared to the prior peak and even hard-hit San Francisco had 1.9% more. The decline in urban renters was smaller in Sunbelt markets, with just a 1.2% and 1.4% decline in Dallas and Atlanta, respectively, and the rebound has been greater with 9.9% and 8.2% more occupied urban units compared to the previous peak.

At the same time, the relative affordability of the Sunbelt has declined. Home values have increased 47.8% in Dallas, 56.3% in Atlanta and 57.5% in Phoenix since 2019 as compared to 26.4% in New York, 36.0% in Boston and 21.3% in San Francisco.6 While major Sunbelt markets remain less expensive compared to Gateway cities, the narrowing of the relative affordability gap should, all else equal, reduce their draw.

Clarifying “urbanization” in DTU+E

As is typically the case, the “rise of the suburbs” narrative overstates the situation, but there are real dynamics behind the shift from urban growth to suburban growth that real estate investors need to pay attention to and build strategies around. At LaSalle, we have long sought to capture secular changes shaping real estate around the world through our Demographics, Technology, Urbanization and Environmental factors (DTU+E) framework. However, the term “urbanization” in this context is often misinterpreted as a one-direction shift towards urban places, when it is better understood as “urban and regional change,” which encompasses broader population shifts within and across metropolitan areas.

Indeed, it was with this lens that LaSalle Research and Strategy forecasted the suburban shift in the mid-2010s and redirected our apartment investment strategy from urban submarkets (what we labeled “Millennial Magnets” at the time) to suburban locations. In 2016, we recommended targeting apartments in the best school districts, which are mostly suburban. We continued to reinforce that focus as our internal target market recommendations shifted towards the suburbs and our risk assessments flagged the challenges facing urban markets. It is not sensible to assume “urbanization” is a one-way street, or that the direction of flow doesn’t change.

Globalizing the urban/suburban debate

To this point, our comments have applied to the US. Elsewhere in the globe, comparisons of suburban versus urban patterns can get tricky for a range of reasons. Even the terminology is challenging. In Australia, all neighborhoods other than CBDs are called “suburbs,” even if they are adjacent to the CBD. In Hong Kong, one might consider transit-centric high-rise New Towns to be “suburbs,” but they do not at all resemble American ones. At some point, the right question is simply: What locations are attracting people?

Looking at it this way requires a deeper dive into demographic, social and urban planning considerations that differ significantly from the US situation. For example, in Japan and Germany, declining rural populations is paired with migration into key cities. In Canada, very strong international in-migration combined with “greenbelts” that limit urban sprawl have led to an intensification of urban density. In the UK, which also has greenbelts, planning restrictions have had the unintended consequence of pushing demand for suburban living into rail-connected satellite cities that are discontinuous to the main built-up area of the metro. To dig into all these and other variations is beyond the scope of this ISA Briefing. However, applying the same lenses of demographic cohort effects, relative affordability and urban structure is a globally relevant approach.

LOOKING AHEAD

- Suburban areas in the US continue to benefit from Millennials and then Generation Z seeking more space for their young families. That said, we do not expect an urban “doom loop,”7 but city taxes could increase more than other locations, limiting urban NOI growth.

- We believe that “E factors”—or environment-related secular changes—are likely to represent generally positive demand drivers for cities. The lower carbon intensity of urban living could boost urban demand if carbon is taxed or otherwise regulated. Moreover, climate change could increase summer heat in southern markets while making northern winters milder. This could tip migration back toward the north.

- High barriers to supply—or the inverse—can equally characterize both urban and suburban locations, depending on local circumstances. That said, the higher share of land value in total asset value in urban locations may imply greater potential for appreciation. Investors should remain on the lookout for urban locations with the best demand dynamics.

- In-migration to Sunbelt markets has driven up housing prices, narrowing affordability gaps with older northern and coastal cities. This should allow other metro areas to emerge as destinations for affordability-driven migration; Columbus, Indianapolis and Louisville are example of cities that may be well positioned to benefit.

1 This is the US definition of a suburb. The concept of what is urban is both hard to define and varies in different markets around the world. In the US urban is generally understood as a dense area at the center of a metropolitan area. Suburbs are defined in contrast to that as being less dense areas that are still highly economically linked to the overall metropolitan area.

2 Commentary in this paragraph based on LaSalle analysis of Census Bureau data.

3 Federal Bureau of Investigation Crime Data Explorer, https://cde.ucr.cjis.gov/LATEST/webapp/#/pages/explorer/crime/crime-trend

4 Urban submarkets as defined by RealPage as the most densely populated submarket(s) in a given market based on a metro’s Central Business District, the highest concentration of the market’s tallest multifamily assets, and/or higher rent per square foot than the market average. This includes the following RealPage submarkets: The Loop, Streeterville/River North, and Lincoln Park/Lakeview in Chicago; Downtown and SoMa in San Francisco; Buckhead, Downtown, Midtown, and Northeast in Atlanta; and Oak Lawn/Park Cities and Intown in Dallas.

5 Data from RealPage as of September 2023

6 Zillow, as of September 2023

7 “Doom loop” refers to a situation in which cities get stuck in a self-reinforcing loop of lower tax revenues requiring cuts to city services that reduce the quality of life which cause residents to leave and further reductions in tax revenues and the loop repeats ad infinitum.

Important Notice and Disclaimer

This publication does not constitute an offer to sell, or the solicitation of an offer to buy, any securities or any interests in any investment products advised by, or the advisory services of, LaSalle Investment Management (together with its global investment advisory affiliates, “LaSalle”). This publication has been prepared without regard to the specific investment objectives, financial situation or particular needs of recipients and under no circumstances is this publication on its own intended to be, or serve as, investment advice. The discussions set forth in this publication are intended for informational purposes only, do not constitute investment advice and are subject to correction, completion and amendment without notice. Further, nothing herein constitutes legal or tax advice. Prior to making any investment, an investor should consult with its own investment, accounting, legal and tax advisers to independently evaluate the risks, consequences and suitability of that investment.

LaSalle has taken reasonable care to ensure that the information contained in this publication is accurate and has been obtained from reliable sources. Any opinions, forecasts, projections or other statements that are made in this publication are forward-looking statements. Although LaSalle believes that the expectations reflected in such forward-looking statements are reasonable, they do involve a number of assumptions, risks and uncertainties. Accordingly, LaSalle does not make any express or implied representation or warranty, and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of the facts, opinions, estimates, forecasts, or other information set out in this publication or any further information, written or oral notice, or other document at any time supplied in connection with this publication. LaSalle does not undertake and is under no obligation to update or keep current the information or content contained in this publication for future events. LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication and nothing contained herein shall be relied upon as a promise or guarantee regarding any future events or performance.

By accepting receipt of this publication, the recipient agrees not to distribute, offer or sell this publication or copies of it and agrees not to make use of the publication other than for its own general information purposes.

Copyright © LaSalle Investment Management 2024. All rights reserved. No part of this document may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of LaSalle Investment Management.

Oct 30, 2024

ISA Focus: Rebalancing past and present

Understanding what past occupier market dislocation can tell us about today’s outlook for global real estate markets, in particular the office sector